FATCA Onboarding

Page's last update : 27 April 2021

Introduction

The Luxembourg Tax Authority (Administration des contributions directes (ACD)) published on 19 January 2017 an updated version of the circular ECHA3 defining the new format that takes into account the Internal Revenue Services (IRS) FATCA XSD 2.0. Luxembourg Financial Institutions will have to use this new schema, as it will be the only one accepted as from now.

FATCA Manual

Please consult our detailed FATCA Manual explaining how to complete the FATCA form and how to transmit the file to the regulator.

Onboarding/Update process FATCA/CRS

Access the configuration file

Once you have contracted the FATCA reporting service, Fundsquare will grant you the access to the web based reporting application e-file. Within the e-file application, you will have access to a specific file called FATCA-CRS onboarding which is available under the Transmission Follow Up module.

Connect to e-file: https://www.e-file.lu/

Select Transmission Follow Up/Report/ FATCA-CRS onboarding

File description

This “FATCA-CRS onboarding” file in XLS format consists of 4 tabs :

- The explanation (brief explanation of all the tabs available and most importantly the specification of the new codification : CRS codification, you will also find the links to the various wiki pages and the e-mail address)

- The depositor details

- The RFI Details – FATCA (prefilled with the existing FATCA set-ups for existing clients)

- The RFI Details – CRS

This document, and specially the 4th tab for CRS, has to be completed if you conduct the CRS reporting for the first time on our platform.

How to complete the file

Existing clients:

When it is a new set-up, please leave the columns “Reserved to Fundsquare” empty.

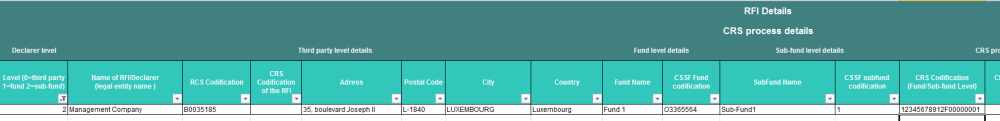

On the RFI Details – FATCA, we have split the configuration in 3 levels:

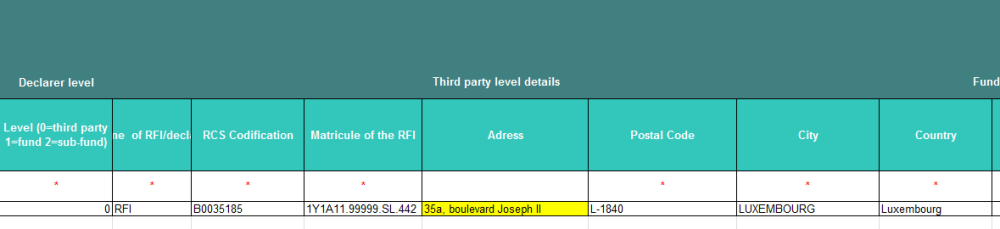

Level 0 : on the RFI level (other than fund)

Level 1 : on the fund level (OPC level)

Level 2 : on the sub-fund level (compartment level)

- If you want to know on which level your FATCA set-up has been made, you can do a filter on the GIIN column.

- If you have to perform any action (change of address, add a date,…) on the RFI Details-FATCA, we ask you to highlight them by using a color on the modified cell(s).

- If you would like to make a modification of an address for a RFI in an existing set-up:<

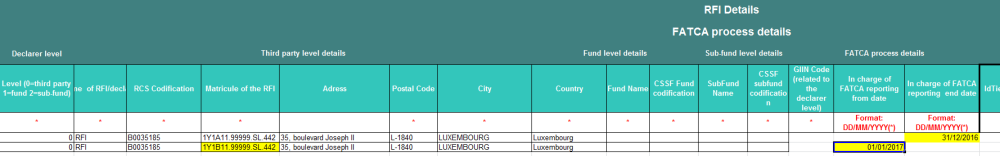

- If you want to modify a GIIN on an existing set-up, we kindly ask you:

To insert a Fatca Reporting End-Date (Reporting Year End)

To copy the line with the new GIIN and add a Fatca Reporting Start Date (Begin of Reporting Year) and highlight those modifications.

- If you no longer perform a reporting for an RFI, please indicate the reporting end date in the designated line so the RFI can be disactivated.

- If you become responsible for the reporting for an RFI, please list the entity/fund/sub-fund and put the reporting start date of the RFI to enable the reporting on your access.

General remark:

- reporting start date: must always be the 1. Jan of the reporting year.

- reporting end date: must always be the 31. Dec of the reporting year.

New clients:

For the new clients to Fundsquare, the tabs RFI Details-FATCA and CRS will be empty.

You can do the reporting either on the RFI (Level 0), on the fund (Level 1) and on the sub-fund (Level 2).

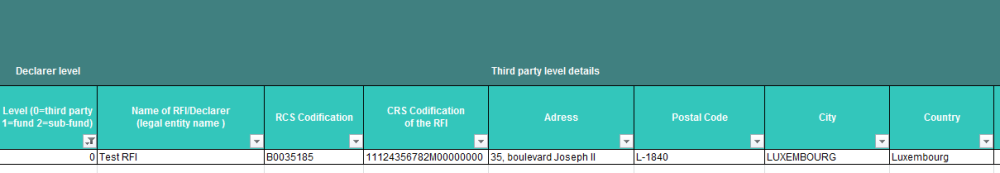

Level 0:

IF your reporting will be on the RFI (Please note that the RFI will always be a Legal Entity), we ask you to give us its Name, its RCS and CRS codification and its address:

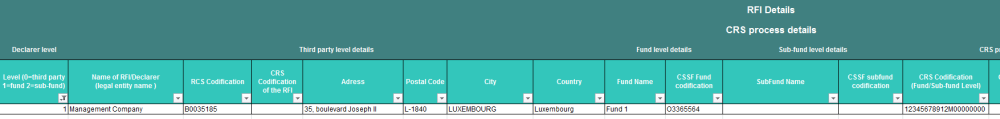

Level 1:

If the reporting will be done on fund level, we kindly ask you to give us its management company, then the name of the fund, its CSSF code and finally its CRS codification:

Level 2:

If your reporting has to be made on sub-fund level, we kindly ask you to give us the fund’s management company, the name of the fund, its CSSF code, its sub-fund, and finally its CSSF and CRS codifications:

On the RFI Details – FATCA/CRS, you will find the last 9 columns reserved for Fundsquare. These columns will be completed once the set-up is effectively done and your information is incorporated into our database.

If you have to perform any action (change of GIIN, add a date,…) on the RFI Details-FATCA, we ask you to highlight them by using a color on the modified cell(s).

Once the document has been completed, please return it by email to: OnboardingFatcaCRS@fundsquare.net

Upon completion of the configuration/set-up by Fundsquare, you will receive a confirmation mail. For any additions/new set-up, please Refresh the Dashboard.

FATCA - FAQ

DISCLAIMER: The FAQ provides an unsorted list of questions Fundsquare has received over the periode of time. To make the most out of it, the questions are shared as well as the provided answers. It is important to note that Fundsquare does under no circumstances provide legal tax advice and the provided answers reflects the current understanding and service delivery as expected by the ACD (Luxembourgish Tax Authority). In certain cases the answers are also provided due to instructions Fundsquare has obtained from the ACD and do not reflect a legal opinion of Fundsquare. Fundsquare can there not be held liable nor responsible for any information provided below. Should you have doubts or further questions on the topic, Fundquare invites you to clarify the situation with the ACD directly.

Adresse:

Bureau de la retenue d'impôt sur les intérêts

de l’Administration des contributions directes

1, rue Auguste Lumière, L-2982, Luxembourg

Tél:

40.800-5555

email: aeoi@co.etat.lu

- What are the filing Entity and the required ID?

The filing entity needs to have a Personal Identification Number which is the Luxembourgish Matricule Number also known as CCSS code. If not available, the ACD is in the position to create a special FATCA reporting ID upon request. To get this code, please contact the ACD.

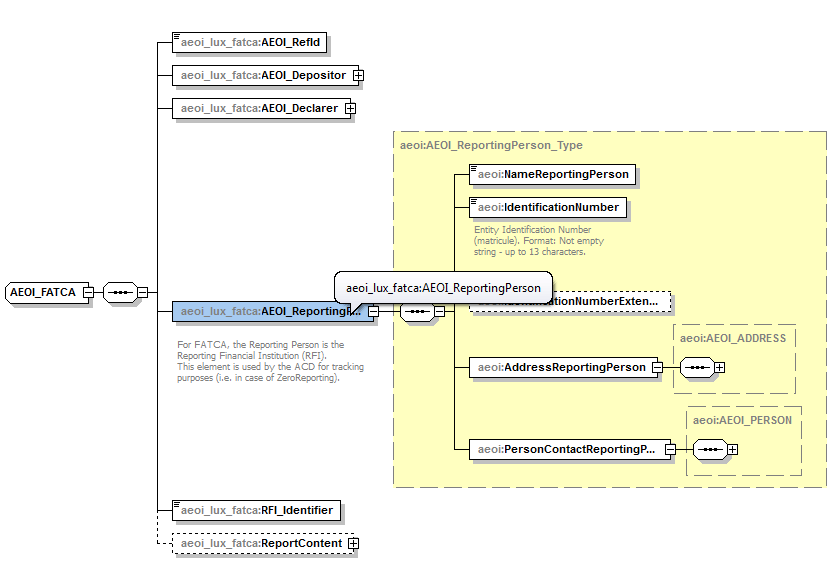

In addition, please not that the Field: «identificationnumberextention» is indicated optional in the XSD, but mandatory according to the ACD. This has an impact on your NIL-reporting as well as other reporting. Previously we communicated that the NIL report format hasn't changed in FACTA 2.0, this is no longer valid, as the handling of aforementioned field impacts any report if not adjusted.

The following information is of high importance to you to prevent rejections by the ACD

- if you use our form, the required field is autofilled with the expected value "M00000000", which is the default value if you have no extention code to communicate

- Should you transmit your FATCA XML via sending service, this error will not be highlighted due to the fact that the XSD of the ACD does not expect a value in the field, so you are highly recommended to amend your XML manually and add this value to the field. - Where file size limited to 30 MB per latest Guidance, where the XML Report from the TA system may be larger, can the splitting be accommodated by Fundsquare for onward submission?

No split is currently done by e-file. It remains the responsbility of the client to manage the file size. - Reference in Guidance to applying UTF-8 encoding for submissions – is this something that e-file applies to the XML and for onward submission?

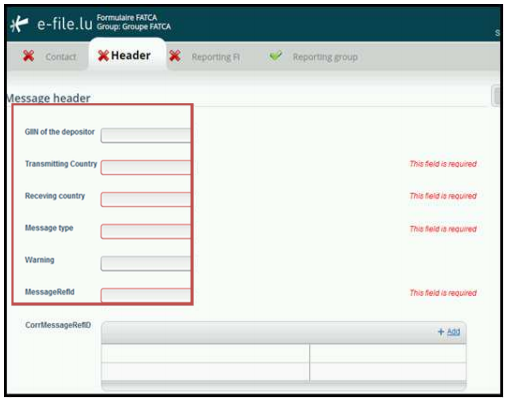

If you do not specify in your encoding standard file (xml tag), you will have to use the standard UTF-8. The whole e-file reporting process (encryption and transmission) uses the standard UTF-8. - What information should feed the below, and who will provide?

AEOI reference: This is the reference of the message and has to be provided by the filing entity. Please be informed that this reference must be provided in capital letters only. Our form respects this rule by default, however the XSD of the ACD does not check this on our sending service and you risk to obtain a rejection of the ACD.

Personal identification number: This is the Luxembourgish Matricule or a code provided upon request to the ACD if the filing entity does not have such a code. This information has to be provided by the filing entity. - Regarding XML reports provided by a third party and uploaded into e-file, does the below information have to be re-entered to be able to send the reporting?

No, this information will be taken from the uploaded file. - Where can I find the latest XSD for FATCA?

Please have a look in the "Useful link" section below. - What are the major changes in FATCA 2.0?

- The below is only an extract and does under no circumstances represent all changes and Fundsquare cannot be held reliable for the completeness of the below information.

- The format for NIL reporting hasn't changed and remains the same.

- For any other reporting (new, updated, correction...) in the following blocks the following information has been either added or updated:

- AEOI_ReportingPerson (added) - This block has been entirely added and corresponds to the reporting financial institution.

- RFI_Identifier (renamed) - This field used to be the field GIIN of the RFI and has been simply renamed to harmonize the identifier with CRS reporting. For Fatca the RFI_Identifier equals the GIIN of the RFI in CRS the ACD expects in this field the luxembourgish "matricule" and extension as outline in the CRS section.

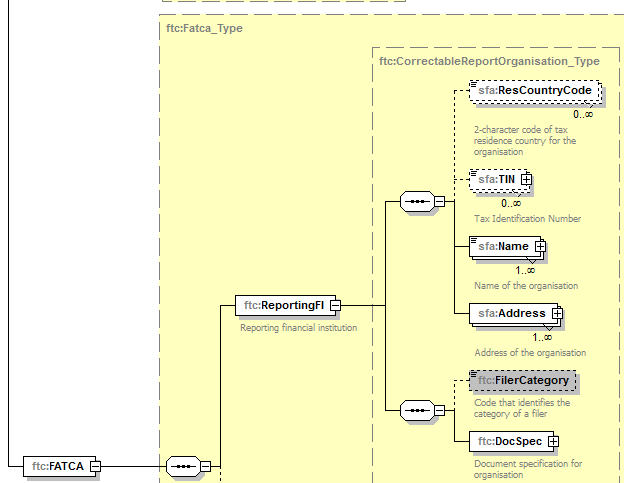

- FilerCategory (added) - In the section ReportingFI the field FilerCategory has been added. The expected values are outlined on page 39 of the following document: https://www.irs.gov/pub/irs-pdf/p5124.pdf

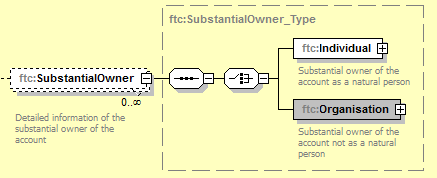

- SubstantialOwner (amended) - In the Account Report section the field Substantial Owner has gotten a new potential type. The entire field is optional, however you can either indicate an Organisation (already existing in Fatca 1.0) or Individual (added). Details are outlined in the XSD.

- AEOI_ReportingPerson (added) - This block has been entirely added and corresponds to the reporting financial institution.

- The below is only an extract and does under no circumstances represent all changes and Fundsquare cannot be held reliable for the completeness of the below information.

- What's the impact for me in regards to FATCA 2.0?

The Luxembourg Tax Authority (ACD) has informed Fundsquare about a maintenance update they are conducting.

For this reason, the FATCA reporting channel and solution in Production & Homologation will not be available

from Friday January 6, 2017 24:00h (LUX)

to Wednesday February 1, 2017 08:00h (LUX)

It is important to note, that the ACD updates the FATCA report format to FATCA 2.0 and thus you will only be able to submit the reports in the current format until Friday January 6, 2017 and after the update only the new format will be accepted. Fundsquare will adapt to this new situation accordingly.

An update of the sending service is required and will be available before the transmission channel reopens again. The webform solution serving FATCA will adapt accordingly. Should you not update your sending service, the files will be transmitted by Fundsquare's system but rejected by the ACD, once you have conducted the update of the sending service, the sending service will already check for the correct version of your FATCA submission.

In anticipation of the introduction of CRS reporting, Fundsquare also would like to inform you about another sending service update when Fundsquare moves into production for CRS reporting (approx.. mid april 2017). Should you need to inform your IT departments well in advance, it is highly recommend to do so now already about these future updates of the sending service. - Where is the corresponding circular on FATCA 2.0?

The Luxembourg Tax Authority (ACD) has released the ruling circular, It can be found on their website as indicated in the newsletter we refer to in our useful link section below. - What about reports I have previously created with the Fundsquare solution (older than FATCA 2.0)?

With the introduction of the new report format, additional fields and information is required. While Fundsquare aims to allow you load your previous report into the webform solution, you will still have to complete the information on the additional fields. The web solution will highlight to you the areas that are incomplete so you can provide the required information - For FATCA submissions within the main IRS schema body of the XML we have the RECEIVINGCOUNTRY element. In the case of FATCA submissions should this be set to ‘US’ or ‘LU’?

See print screen below of the web solution showing the expected values:

- In V2.0 of the IRS schema the FilerCategory element is a mandatory field for Reporting FI’s. Do you know if this field is required within the updated LUX_AEOI schema?

According to Fundsquare's current understanding and information we obtained from the ACD, this category is a mandatory field and the expected values are listed in the IRS document (https://www.irs.gov/pub/irs-pdf/p5124.pdf page: print version 39) - It is our understanding that a test portal exists for FATCA submissions to be pre validated. When we submit to the test portal are we okay to end our files with ‘P’ even though they are being loaded to the test portal? Would we also be okay to use the FATCA 1 production DocTypeIndic for submissions to the test portal? This would prevent our operations teams having to change the file name from T to P each time a test vs Production submission is made.

You can test in test environment but not submit “P” reports in test. They would be rejected and must be labelled “T” in test. - My fund had a sponsored GIIN from a sponsoring entity (GIIN type "SP"), can I continue to use the "SP" GIIN for the fund/RFI?

According to Fundsquare's current understanding and information we obtained from the ACD, The fund or any other RFI should have obtained its appropriate own GIIN for the reporting periode 2016. The IRS has therefore introduced additional GIIN number types such as but not limited to "SF"... You can provide the updated GIIN number to Fundsquare so the data enriching of the web solution can be updated accordingly. You can provide this information to fatca_onboarding@fundsquare.net stating the previous GIIN number and the updated GIIN number and the name of the RFI.

Training Sessions

There is currently no training foreseen for this module.