CRS Onboarding

Page's last update : 15 March 2021

Introduction

General Definition

CRS - Common Reporting Standard / NCD: Norme commune de déclaration

The Common Reporting Standard (CRS), formally referred to as the Standard for Automatic Exchange of Financial Account Information, is an information standard for the automatic exchange of information (AEoI), developed in the context of the Organisation for Economic Co-operation and Development (OECD). (Source: Wikipedia)

CRS Manual

Please consult our detailed CRS Manual explaining how to complete the CRS form and how to transmit the file to the regulator.

e-file.lu - Service Offer

If you are already familiar with our service offer for FATCA, you will see no major difference in our offer for CRS. You will have the possibility to

- transmit your CRS-XML file to the ACD via our STP-Sending Service

- establish a CRS-XML file according to the specifications of the ACD with our online webform

- cross-check your CRS-XML file against the business rules and controls the ACD communicates to us and that we incorporate in our websolution

- the webform or full autmatic transmission with Fundsquare expects XML reports to be imported into the solution. Any other format would have to be converted into XML before Fundsquare solution can take it into account.

Prerequisites for the CRS reporting

Besides the fact that you will have to have the CRS module in e-file.lu in order to transmit the CRS-XML files, the technical submitter of the report (entity that will sign the contract for the CRS-module with Fundsquare, fr: déposant) as well as the reporting entity (entity that identified reportable clients, fr: déclarant) will have to have a luxembourgish "matricule".

Should you not hold a luxembourgish matricle ID, Please contact the Luxembourg Tax Authority (Administration des contributions directes (ACD))

-by mail: aeoi@co.etat.lu

-by phone: Phone book_Bureau de la retenue d'impôt sur les intérêts

Onboarding/Update process FATCA/CRS

Access the configuration file

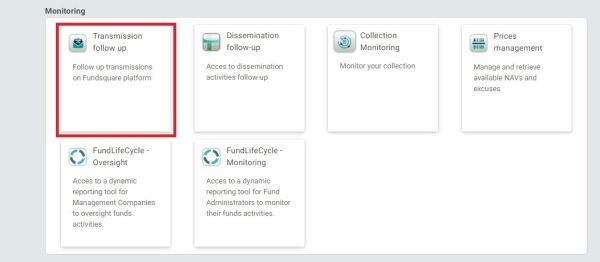

Once you have contracted the CRS reporting service, Fundsquare will grant you the access to the web based reporting application e-file. Within the e-file application, you will have access to a specific file called FATCA-CRS onboarding which is available under the Transmission Follow Up module.

Connect to e-file: https://www.e-file.lu

Select Transmission Follow Up/Report/ FATCA-CRS onboarding

File description

This FATCA-CRS onboarding file in XLS format consists of 4 tabs :

- The explanation (brief explanation of all the tabs available and most importantly the specification of the new codification : CRS codification, you will also find the links to the various wiki pages and the e-mail address)

- The depositor details

- The RFI Details – FATCA (prefilled with the existing FATCA set-ups for existing clients)

- The RFI Details – CRS

This document, and specially the 4th tab for CRS, has to be completed if you conduct the CRS reporting for the first time on our platform.

CRS Codification:

Please find below the major specificities of the new ACD codification:

- Case 1:

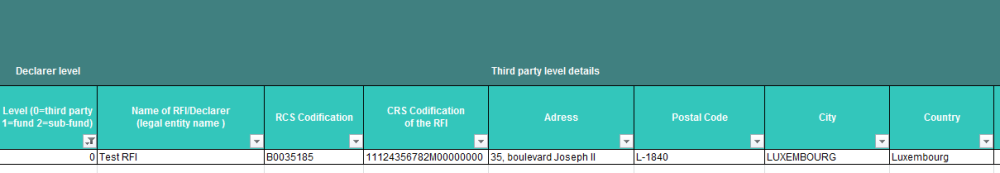

- RFI is a legal entity but not a fund or sub-fund (level 0) with a LU matricule (11 digit code, also used for Social Security declarations…): The codification will correspond to the matricule of the RFI in 11 characters with the suffix "M00000000"

Example: 12345678974M00000000

- RFI is a legal entity but not a fund or sub-fund (level 0) with a LU matricule (11 digit code, also used for Social Security declarations…): The codification will correspond to the matricule of the RFI in 11 characters with the suffix "M00000000"

- Case 2:

- RFI is a fund (level 1) with a LU matricule and reporting will happen on fund level: The codification will correspond to the matricule of the RFI in 11 characters (used to declare the Taxe d’abonnement…) with the suffix "M00000000"

Exemple: 12345678912M00000000

- RFI is a fund (level 1) with a LU matricule and reporting will happen on fund level: The codification will correspond to the matricule of the RFI in 11 characters (used to declare the Taxe d’abonnement…) with the suffix "M00000000"

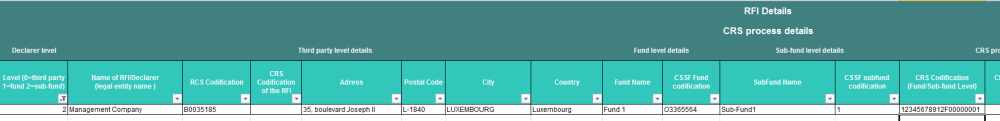

- Case 3:

- The RFI is a fund with a LU matricule and reporting will happen on sub-fund level (level 2): The codification will compose of the LU matricule of the fund in 11 characters (used to declare the Taxe d’abonnement…) followed by "F" and the CSSF sub-fund code filled up with leading 8 up to 8 digits.

Exemple: 12345678912F00000123

- The RFI is a fund with a LU matricule and reporting will happen on sub-fund level (level 2): The codification will compose of the LU matricule of the fund in 11 characters (used to declare the Taxe d’abonnement…) followed by "F" and the CSSF sub-fund code filled up with leading 8 up to 8 digits.

You will find on the First Tab of the FATCA-CRS Onboarding file, a detail regarding other existing cases.

How to complete the file

Existing clients:

For existing clients, if you need to do a CRS report on the same FATCA set-up, you can do a copy-paste from the RFI Details – FATCA into the RFI Details – CRS tab including the info from the columns "Reserved to Fundsquare" and enter the CRS codifications (on RFI level or on fund/sub-fund levels)

Just copy the level where the reporting will be done (level 0 for RFI legal entity, level 1 for Fund and level 2 for Sub-Fund)

When it is a new set-up, please leave the columns “Reserved to Fundsquare” empty.

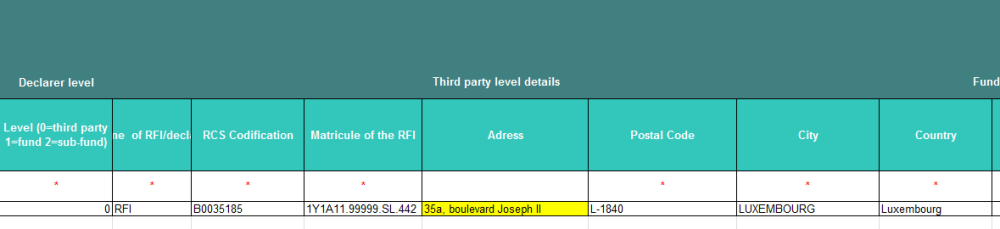

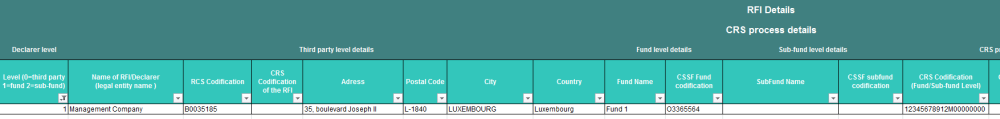

On the RFI Details – FATCA, we have split the configuration in 3 levels:

Level 0 : on the RFI level (other than fund)

Level 1 : on the fund level (OPC level)

Level 2 : on the sub-fund level (compartment level)

If you have to perform any action (change of address, add a date,…) on the RFI Details-FATCA, we ask you to highlight them by using a color on the modified cell(s).

- If you would like to make a modification of an address for a RFI in an existing set-up:

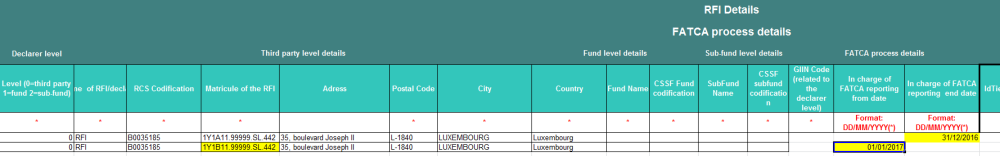

- If you want to modify a GIIN on an existing set-up, we kindly ask you:

To insert a Fatca Reporting End-Date (Reporting Year End)

To copy the line with the new GIIN and add a Fatca Reporting Start Date (Begin of Reporting Year) and highlight those modifications.

- If you no longer perform a reporting for an RFI, please indicate the reporting end date in the designated line so the RFI can be disactivated.

- If you become responsible for the reporting for an RFI, please list the entity/fund/sub-fund and put the reporting start date of the RFI to enable the reporting on your access.

General remark:

- reporting start date: must always be the 1. Jan of the reporting year.

- reporting end date: must always be the 31. Dec of the reporting year.

New clients:

For the new clients to Fundsquare, the tabs RFI Details-FATCA and CRS will be empty.

You can do the reporting either on the RFI (Level 0), on the fund (Level 1) and on the sub-fund (Level 2).

Level 0:

If your reporting will be on the RFI (Please note that the RFI will always be a Legal Entity), we ask you to give us its Name, its RCS and CRS codification and its address:

Level 1:

If the reporting will be done on fund level, we kindly ask you to give us its management company, then the name of the fund, its CSSF code and finally its CRS codification:

Level 2:

If your reporting has to be made on sub-fund level, we kindly ask you to give us the fund’s management company, the name of the fund, its CSSF code, its sub-fund, and finally its CSSF and CRS codifications:

On the RFI Details – FATCA/CRS, you will find the last 9 columns reserved for Fundsquare. These columns will be completed once the set-up is effectively done and your information is incorporated into our database.

If you have to perform any action (change of GIIN, add a date,…) on the RFI Details-FATCA, we ask you to highlight them by using a color on the modified cell(s).

Once the document has been completed, please return it by email to: OnboardingFatcaCRS@fundsquare.net

Upon completion of the configuration/set-up by Fundsquare, you will receive a confirmation mail. For any additions/new set-up, please Refresh the Dashboard.

CRS - FAQ (Questions either answered by Fundsquare or ACD)

DISCLAIMER: The FAQ provides an unsorted list of questions Fundsquare has received over the periode of time. To make the most out of it, the questions are shared as well as the provided answers. It is important to note that Fundsquare does under no circumstances provide legal tax advice and the provided answers reflects the current understanding and service delivery as expected by the ACD (Luxembourgish Tax Authority). In certain cases the answers are also provided due to instructions Fundsquare has obtained from the ACD and do not reflect a legal opinion of Fundsquare. Fundsquare can there not be held liable nor responsible for any information provided below. Should you have doubts or further questions on the topic, Fundquare invites you to clarify the situation with the ACD directly.

Adresse:

Bureau de la retenue d'impôt sur les intérêt de l’Administration des contributions directes

1, rue Auguste Lumière, L-2982, Luxembourg

Tél: 40.800-5555

email: aeoi@co.etat.lu

(1) Do you have a sample of the expected XML for CRS reporting?

Fundsquare: The ACD has provided a sample on their website. The link to it is provided in the below link section of this page.

(2) Does the solution allow to report to other domiciles than Luxembourg?

Fundsquare: The current product offer on CRS allows you to submit the reports to the ACD (Luxembourg Tax Authority) as a Financial Institution that's deemed required to report to the ACD. The ACD acts as a consolidator for all declarations that need to be transmitted to the foreign authorities. It is also the ACD who will receive the feedbacks from the foreign authorities if available, that the ACD will relay to you via the official communication channel.

(3) Les prérequis quant au format de fichier à transmettre à l'ACD sont-ils déjà connus?

Fundsquare: Oui, l’ACD a communiqué le xsd.

Comme pour FATCA nous allons avoir deux possibilités pour envoyer le rapport règlementaire :

* En déposant le fichier directement sur le service déposant du client en respectant la convention de nommage ACD

- En utilisant le formulaire mis à disposition par FSQ à travers le module « génération de rapport » sur Efile

- Le fichier XML du message CRS devra être encodé en UTF-8

- Fundsquare a mis en place des règles au niveau du formulaire afin d’être sûr que le rapport ne sera pas rejeté par le régulateur

(4) Nous entendons parler de la possibilité de n'envoyer qu'un seul fichier comprenant tous les fonds à reporter ... Ceci ne nous semble pas logique dans le sens où chaque fonds a sa personnalité juridique. Si on compare au reporting FATCA, il s'agit bien d'envoyer un fichier par fonds à reporter. De plus concernant la nationalité des investisseurs, est-il possible de confirmer que le seul fichier à transmettre à l'ACD via e-file pour chaque fonds suffira à cette dernière pour faire le dispatch des informations vers les différents pays?

Fundsquare: Il ne sera pas possible d’envoyer un rapport CRS pour plusieurs fonds. La XSD ne le permet pas et l'autorité ne l’a donc pas prévu comme telle. Dans le reporting CRS, le fonds déclarant reporté pourrait être lié à plusieurs investisseurs étrangers, dans ce cas, il est prévu dans le rapport au niveau du « reporting group » de déclarer le reporting FI et account report par pays. L’ACD fera ensuite le split et le dispatch vers les pays concernés.

(5) Whats the maximum file size of each single CRS XML? of the Fundsquare:: The ACD has already confirmed to us that the maximum file size they will accept is 60MB per CRS XML. Please note the encryption doubles the size of the file. We have therefore foreseen that the sending service will not transmit any file larger than 60MB (30MB before encryption). In addition, our webform is not meant to cope with so many lines as they will be hard to monitor. Our Websolution is addressed to organizations that are unable to produce the CRS-XML independantly, and those who would like to check their CRS-XML files with few lines also against the business rules of the ACD. High volume reports shall be either split in smaller lots and be uploaded one by one, or you can cross-check your CRS-XML file against the XSD with a so-called XML-checker. Several different solutions are available online. Please be aware that the additional business rules the ACD has defined are not necessarily part of the XSD and thus will not be checked with an XML-checker. Those business rules can only be tested with our webform.

(6) How would I know the jurisdiction of tax residency for CRS reporting?

Fundsquare: Under the CRS, tax authorities require financial institutions to collect and report certain information relating to their customers' tax statuses. The financial institution can obtain certainty of the jurisdiction of tax residency by enforcing a "self-certification" process over the client and collect this information under the CRS. All financial institutions - that includes banks, insurers and asset management businesses - in participating countries - are required to be compliant with the CRS. It is your clients duty to define its tax residence. Please contact a professional tax advisor or check the OECD website for more information on how to determin the tax residency as Fundsquare cannot provide tax advice.

(7) Does Fundsquare provide a CSV/XLS importer or converter to convert the raw data into the expected XML format

Fundsquare: The Sending Service (service deposant) or the webform expects that the client provides an XML respecting the XSD for any import. Furthermore, a user can establish a brand new XML by completing the webform and exporting the XML as either draft or final version. Nevertheless, Fundsquare is currently evaluation the possibility to partner with a third party provider that furnishes an CSV/XLS to CRS XML converter. This is still under evaluation and no commitment for any preferred partner has been done yet.

CRS - e-file Training Sessions

There is currently no training foreseen for this module.

Useful Links

- Commercial Information of CRS on our website

- Commercial Flyer of Fundsquare's CRS Solution

- Official Website of the Luxembourg Tax Authority ACD on CRS

- Official Circular ECHA4 ruling CRS reporting in Luxembourg

- XSD for the CRS reporting

- Sample XML for CRS reporting

- FAQ of the ACD related to CRS

- Luxembourg Law ruling the CRS in the Grand Duchy

- FAQ of the OECD related to CRS

- Rules governing tax residence (provided by OECD)

- Wiki-CRS Manual