CRS Manual

Introduction

The Luxembourg Tax Authority (Administration des contributions directes (ACD)) published on 6 February 2017 the ECHA - n° 4 Circular. This Circular describes the format and procedures of the Common Reporting Standard (CRS) that Luxembourg Reporting Financial Institutions (RFI) will have to follow according to the CRS Luxembourg law, 24 December 2015.

Manual filing through e-file v2

Environment

Step 1: Select your environment:

Production environment : https://www.e-file.lu/e-file/

Homologation environment (Test) : https://homologation.e-file.lu/e-file/

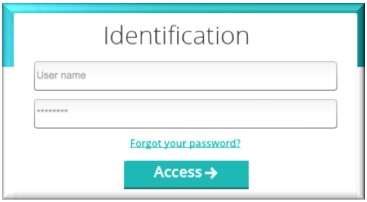

Login

Step 1: Enter your e-file login credentials (user name and password) and click the Access button.

IMPORTANT: If you do not have an e-file user account or if you do not remember your password, you might contact your e-file administrator of your company.

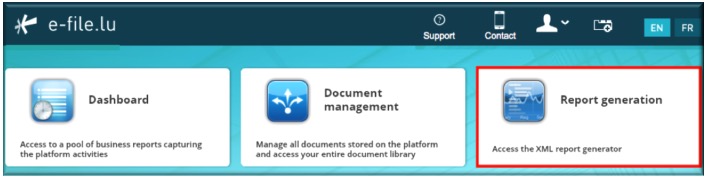

Access CRS form

Step 1: Click on the Report Generation icon:

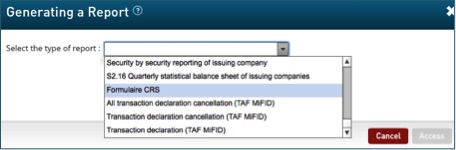

Step 2: Select Formulaire CRS

Result: the CRS form opens

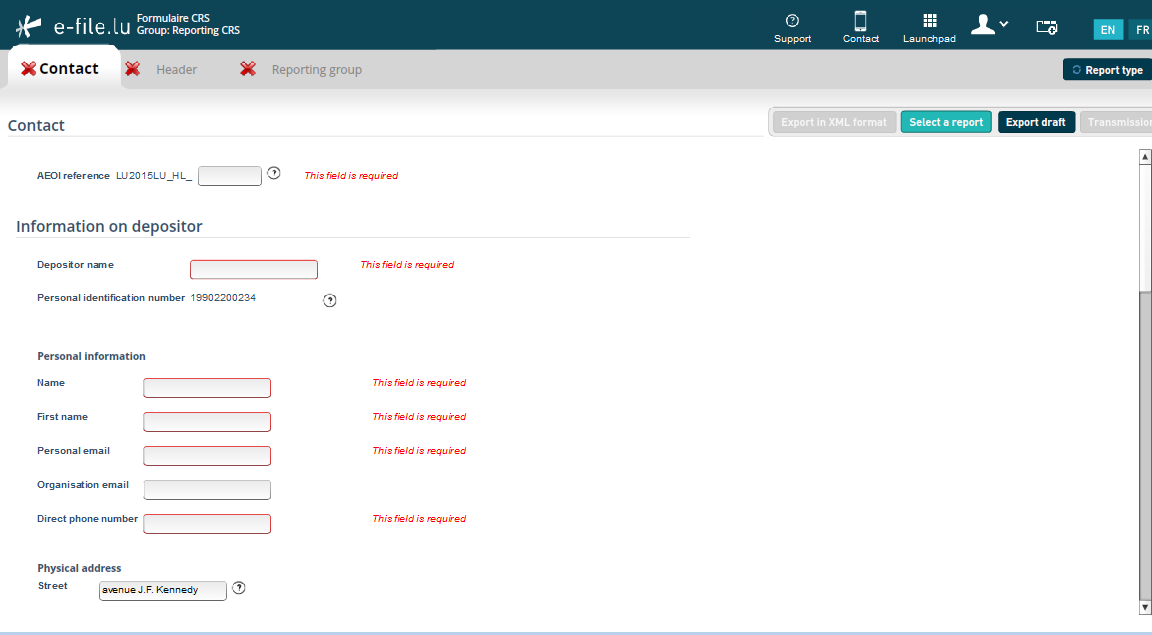

Complete CRS form

AEOI reference

[[File:]]

Finally, the third block is a unique identifier of up to 67 alphanumeric characters determined by the Luxembourg Financial Institution which constitutes the XML file. It is recommended to use as a unique technical identifier a "timestamp", a digital counter or a "GUID". The DCO asks not to include confidential data in the identifying elements.

- AEOI reference: this field has to be completed with a unique identifier. The ACD recommends to use a "timestamp", a digital counter or a "GUID" (Globally Unique Identifier). The ACD asks not to include confidential data in the identifying elements.