CRS Manual

Jump to navigation

Jump to search

Introduction

The Luxembourg Tax Authority (Administration des contributions directes (ACD)) published on 6 February 2017 the ECHA - n° 4 Circular. This Circular describes the format and procedures of the Common Reporting Standard (CRS) that Luxembourg Reporting Financial Institutions (RFI) will have to follow according to the CRS Luxembourg law, 24 December 2015.

Manual filing through e-file v2

Environment

Step 1: Select your environment:

Production environment : https://www.e-file.lu/e-file/

Homologation environment (Test) : https://homologation.e-file.lu/e-file/

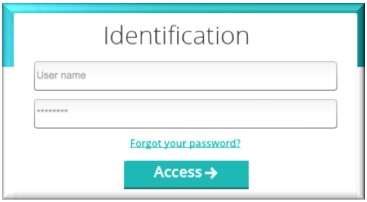

Login

Step 1: Enter your e-file login credentials (user name and password) and click the Access button.

IMPORTANT: If you do not have an e-file user account or if you do not remember your password, you might contact your e-file administrator of your company.

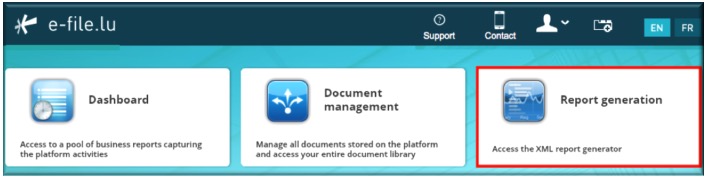

Access CRS form

Step 1: Click on the Report Generation icon:

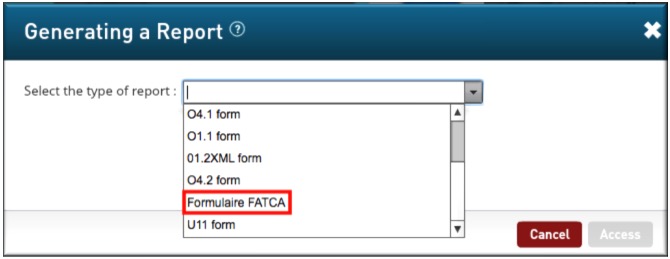

Step 2: Select Formulaire FATCA

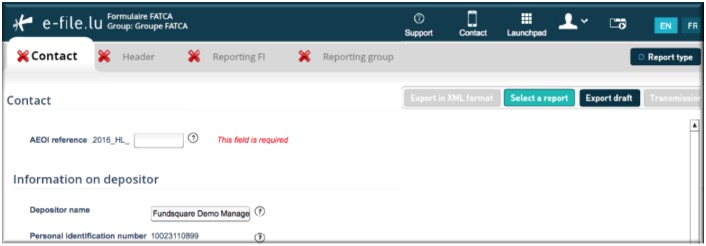

Result: the FATCA form opens