Difference between revisions of "Test3"

| Line 380: | Line 380: | ||

[[File:CRS-After-Reporting FI 2nScreenNew.png|border|700 px]] | [[File:CRS-After-Reporting FI 2nScreenNew.png|border|700 px]] | ||

Click on the Reporting FI icon [[File:After-CRS-Reporting FI | Click on the Reporting FI icon [[File:After-CRS-Reporting FI icon2.png|80 px]] as indicated above. The drawer '''Reporting FI''', which we highlighted in yellow, opens. | ||

Complete the fields. Mandatory fields are marked with a red asterix. | |||

<u>'''Residence country'''</u> <br /> The country or countries of tax residence of the Luxembourg RFI. The "Residence country" element corresponds to the country or countries of tax residence of the Luxembourg RFI. There must be at least one element which has the value "LU". In addition, the value of the "Residence country" element must be equal to the value of the "TransmittingCountry" element, otherwise the file is rejected with error code 60013. <br /> Cf. [http://www.impotsdirects.public.lu/content/dam/acd/fr/legislation/legi17/ECHA4.pdf ECHA - n° 4 of 6 February 2017, page 34]. | <u>'''Residence country'''</u> <br /> The country or countries of tax residence of the Luxembourg RFI. The "Residence country" element corresponds to the country or countries of tax residence of the Luxembourg RFI. There must be at least one element which has the value "LU". In addition, the value of the "Residence country" element must be equal to the value of the "TransmittingCountry" element, otherwise the file is rejected with error code 60013. <br /> Cf. [http://www.impotsdirects.public.lu/content/dam/acd/fr/legislation/legi17/ECHA4.pdf ECHA - n° 4 of 6 February 2017, page 34]. | ||

Revision as of 11:28, 16 January 2020

Introduction

Dies ist ein kurzer TEST

The Luxembourg Tax Authority (Administration des contributions directes (ACD)) published on 6 February 2017 the ECHA - n° 4 Circular. This Circular describes the format and procedures of the Common Reporting Standard (CRS) that Luxembourg Reporting Financial Institutions (RFI) will have to follow according to the CRS Luxembourg law, 24 December 2015.

Manual filing

Please be informed that we are working on a new e-file version that will be delivered throughout 2020.

This modernized e-file version will introduce a new design and improved ergonomics for a better user experience.

This new version of e-file will be deployed module per module, supported by a dedicated communication plan to ensure a proper transition to the impacted users.

Project timeline:

- e-file form CRS as of Q1 2020

Please find below our Before - After user guide where we will explain all important changes.

Environment

Select your environment.

Production environment : https://www.e-file.lu/e-file/

Homologation environment (Test) : https://homologation.e-file.lu/e-file/

E-file login

Enter your e-file login credentials (user name and password) and click the Access button

IMPORTANT: If you do not have an e-file user account, you might contact your e-file administrator of your company.

=>for more detailed information please click the link e-file Administration

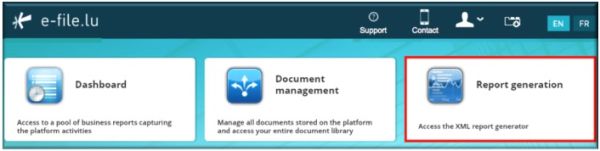

E-file launchpad

Once your are logged in, the e-file launchpad opens.

Click on the Report Generation icon.

Report type

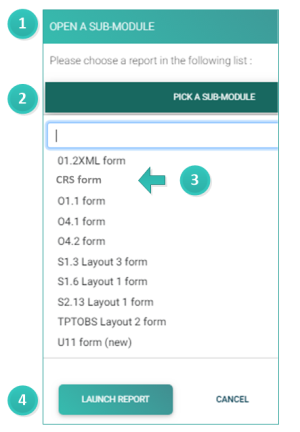

![]() Once you have clicked on the Report Generation icon, the window OPEN A SUB-MODULE pops-up.

Once you have clicked on the Report Generation icon, the window OPEN A SUB-MODULE pops-up.

![]() Click on PICK A SUB-MODULE. A drop-down list opens from which you have to select your reporting type.

Click on PICK A SUB-MODULE. A drop-down list opens from which you have to select your reporting type.

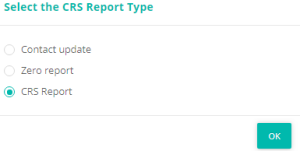

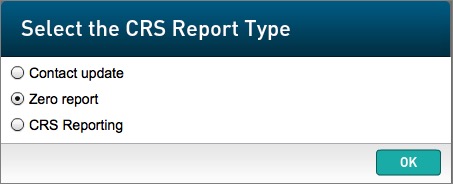

The CRS Report form opens and a small window pops up where you have to select the CRS report type.

In our example we will select CRS Report.

CRS form Before - After

BEFORE

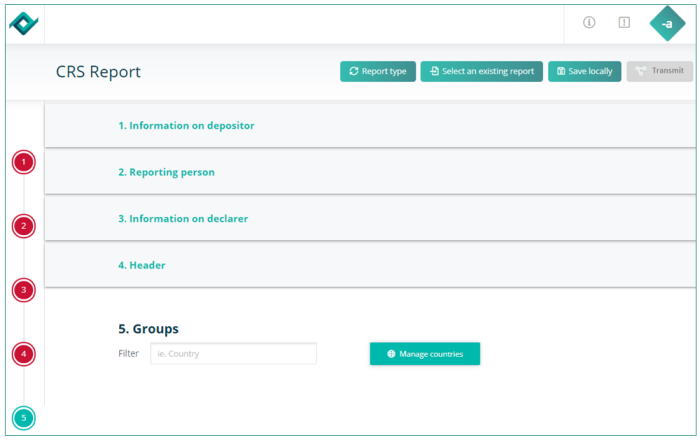

AFTER

Main changes: the horizontal tabbed navigation bar in the old e-file version has been replaced by a vertical navigation bar.

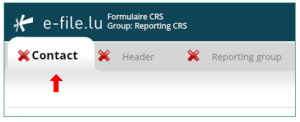

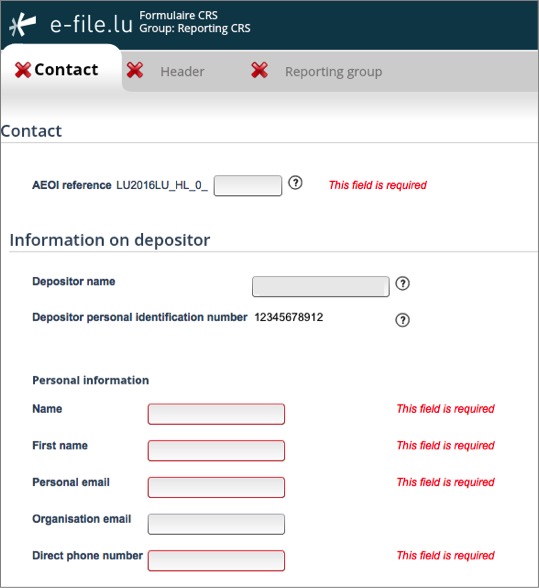

Contact tab

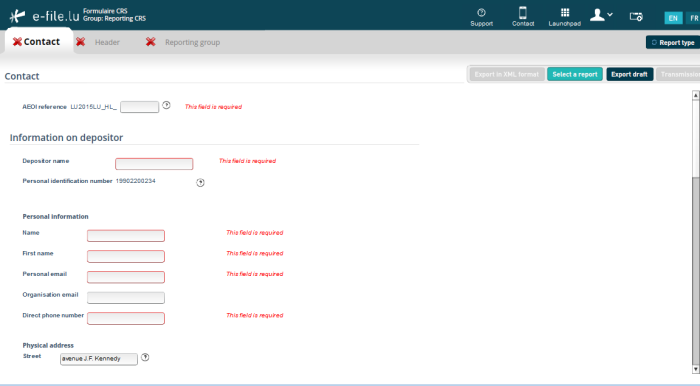

BEFORE

In the old e-file version, the Contact tab contained information on Depositor, Declarer, Reporting person

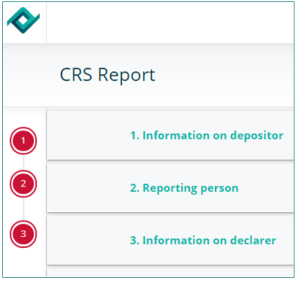

AFTER

In the new e-file version the Contact tab has been splitted into 3 sections:

1. Information on depositor

2. Reporting person

3. Information on declarer

These three sections can be accessed via the buttons in the vertical navigation bar or via the navigation buttons NEXT STEP ![]() and PAGE UP

and PAGE UP ![]() inside each page.

inside each page.

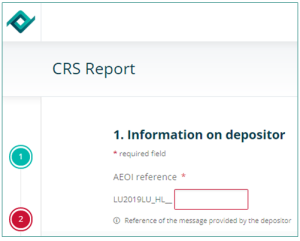

AEOI reference

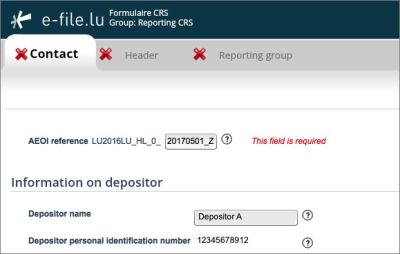

BEFORE

In the old e-file version, the AEOI reference field was available in the Contact tab.

AFTER

In the new e-file version, you can find the AEOI reference field in the first section of the CRS form under Information on depositor.

-This field has to be completed with a unique identifier.

-The ACD recommends to use a "timestamp", a digital counter or a "GUID" (Globally Unique Identifier).

-Specification examples: only capital characters (A-Z), number 0-9, must be unique, etc.

-The ACD asks not to include confidential data in the identifying elements.

Cf. ECHA - n° 4 of 6 February 2017, page 21-22.

Information on depositor

BEFORE

In the old e-file version the Information on depositor had to be completed in the Contact tab.

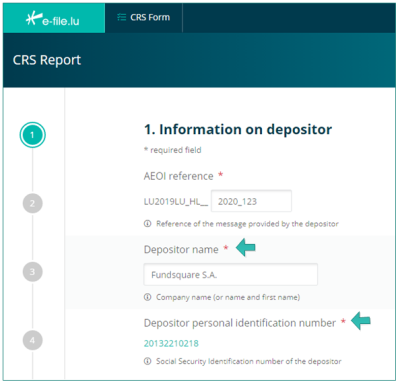

AFTER

In the new e-file version the Information on depositor has to be completed in the section 1 of the form.

Depositor name (pre-filled)

The Depositor is an entity (legal or natural person) that is in charge of filing the CRS reporting to the ACD (e.g. Service provider). The depositor and the declarer may be the same entity.

Cf. ECHA - n° 4 of 6 February 2017, page 10.

Personal Identification Number (pre-filled)

The Depositor needs a Personal Identification Number (Luxembourgish Matricule Number also known as CCSS code) to be able to file the report.

If the Depositor does not have a Luxembourgish Matricule Number, he has to contact the Bureau de la retenue d'impôt sur les intérêts to obtain one (Form 914F).

-by phone: Phone book_Bureau de la retenue d'impôt sur les intérêts

IMPORTANT: all pre-filled data have to be communicated to Fundsquare in order to be integrated in Fundsquare's database and to be available in the CRS form.

=> Consult our CRS Onboarding process for more detailed information.

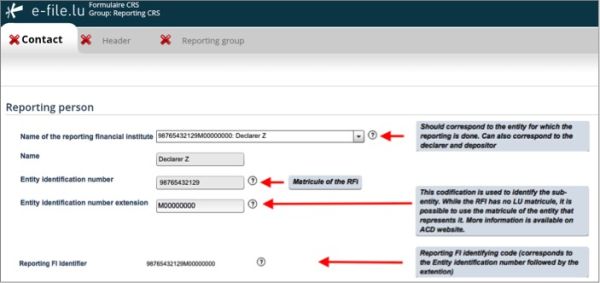

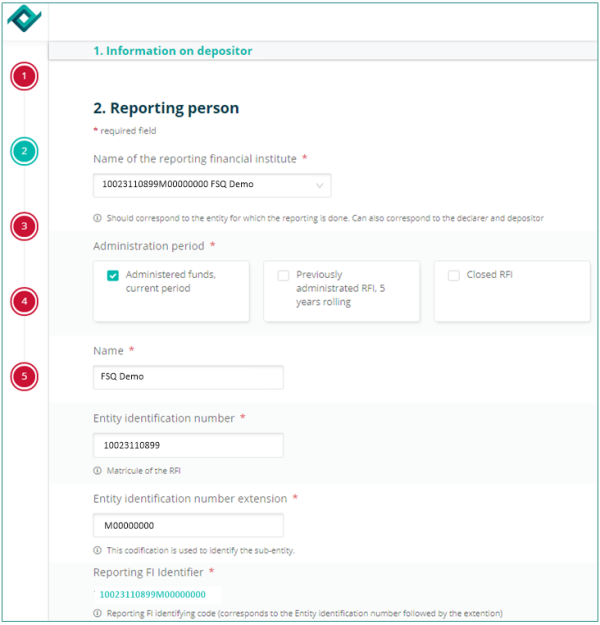

Reporting person

BEFORE

In the old e-file version, information on the Reporting person had to be completed in the Contact tab

AFTER

In the new e-file version the Reporting person information has to be completed in section 2 of the form.

The Reporting Person is the Reporting Financial Institution (RFI) that is subject to the CRS Reporting.

Name of the Reporting Financial Institution

Select the entity in the drop-down list for which the reporting has to be done.

Name

Name of the RFI (pre-filled once the RFI has been selected)

Entity Identification number

The Identification number is the Luxembourgish Matricule number of the RFI (pre-filled once the RFI has been selected)

Entity Identification number extension

The extension of the Luxembourgish Matricule number (pre-filled once the RFI has been selected). Example of an UCI that reports on UCI level: M00000000 (The Reporting FI Identifier will be 12345678912M00000000)

If a sub-entity wants to submit a CRS reporting to the ACD and does not have a personnel number, it puts the parent entity's number in the Entity Identification number field and an additional identifier in the Entity Identification number extension field. Example: a sub-fund that wants to report directly, can enter the umbrella number (= tax identification number available on the subscription-tax returns) in the Entity Identification number field and the sub-fund number (CSSF code of the sub-fund) in the Entity Identification number extension field. Exemple: F00000002 (The Reporting FI Identifier will be 12345678912F00000002)

IMPORTANT: instructions published on the ACD website should be followed in the event that the Luxembourg Financial Institution has no Luxembourgish matricule.

Reporting FI Identifier

It is the concatenation of the Identification Number and Identification Number Extension (pre-filled once the RFI has been selected).

IMPORTANT: all pre-filled data have to be communicated to Fundsquare in order to be integrated in Fundsquare's database and to be available in the CRS form

=> Consult our CRS Onboarding process for more detailed information.

=> Send mail to: OnboardingFatcaCRS@fundsquare.net

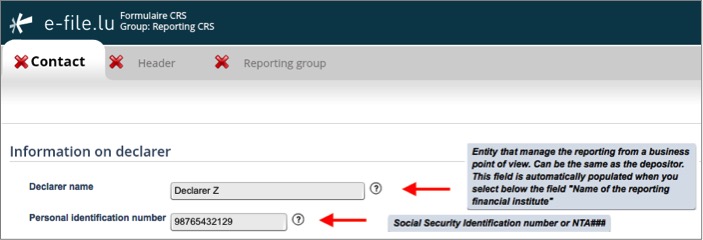

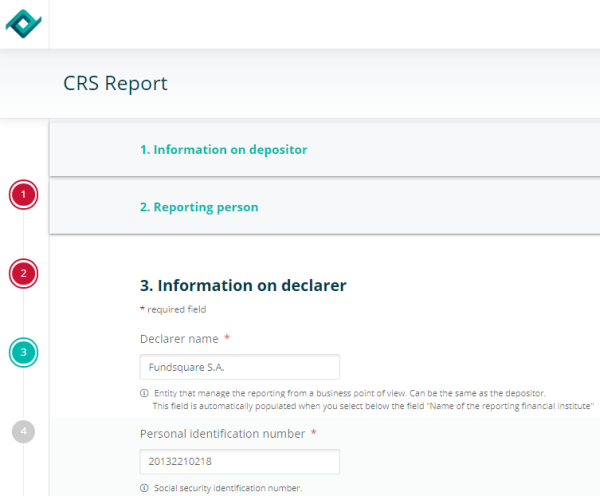

Information on declarer

BEFORE

In the old e-file version the Information on declarer had to be completed in the Contact tab.

AFTER

In the new e-file version the Information on declarer information has to be completed in section 3 of the form.

Declarer name

The declarer is the entity that manages the reporting from a business point of view e.g. a management company.The ACD needs contact details of a person who would be able to answer business questions regarding the report.

Cf. ECHA - n° 4 of 6 February 2017, page 10

Personal identification number

Social Security Identification Number (Matricule, code CCSS) of the declarer.

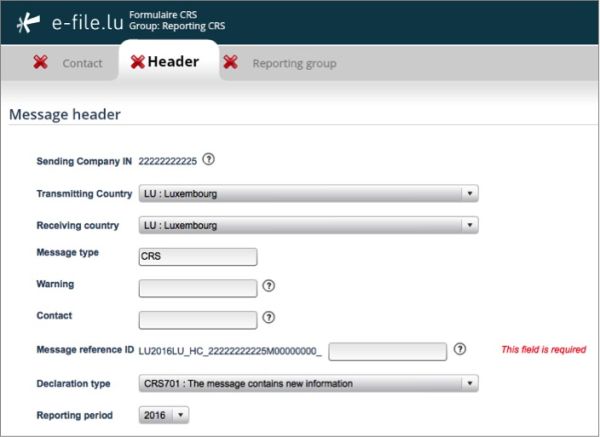

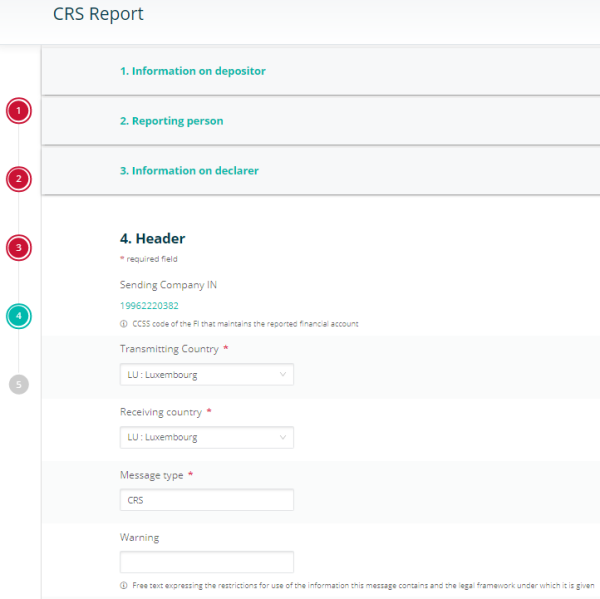

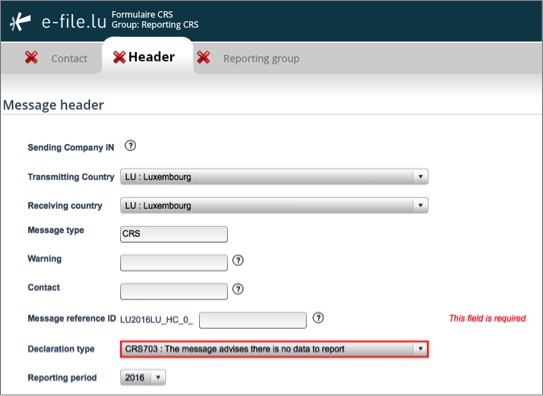

Header tab

BEFORE

In the old e-file version the Message header information had to be completed in the Header tab.

AFTER

First part of the screenshot CRS report Header

In the new e-file version the Header information has to be completed in section 4 of the form.

The information in the header tab identifies the Competent Authority that is sending the message, as well as the Competent Authority receiving the message. It specifies when the message was created and the nature of the report.

Transmitting country

Must always be LU. This data element identifies the jurisdiction of the Competent Authority transmitting the message, which is the Competent Authority that has received the initial CRS message.

Cf. ECHA - n° 4 of 6 February 2017, page 28.

Receiving country

Must always always be LU. This data element identifies the jurisdiction of the Competent Authority receiving the message, which is the Competent Authority that has sent the initial CRS message.

Cf. ECHA - n° 4 of 6 February 2017, page 28.

Warning

This optional data element is a free text field allowing input of specific cautionary instructions about use of the CRS Status Message.

Cf. ECHA - n° 4 of 6 February 2017, page 30.

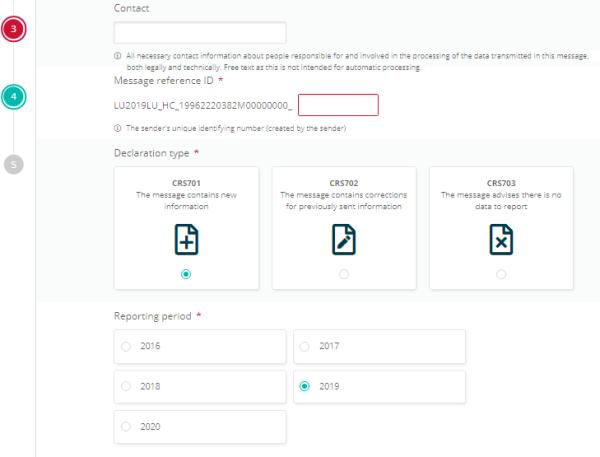

Second part of the screenshot CRS report Header

Contact

This optional data element is a free text field allowing input of specific contact information for the sender of the message (i.e. the Competent Authority sending the CRS Status Message).

Cf. ECHA - n° 4 of 6 February 2017, page 30.

Message reference ID

This field has to be completed with a unique identifier.

The ACD recommends to use a "timestamp", a digital counter or a "GUID" (Globally Unique Identifier).

Specification examples: only capital characters (A-Z), number 0-9, must be unique, etc.

The ACD asks not to include confidential data in the identifying elements.

Cf. ECHA - n° 4 of 6 February 2017, page 21-22 and page 28.

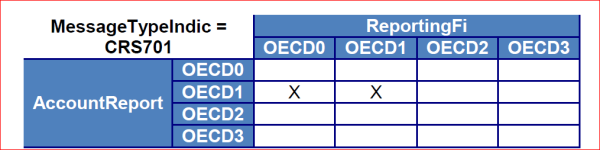

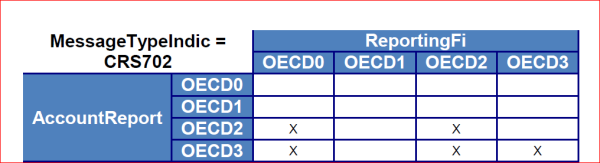

Declaration type

In the new e-file version the drop down list for the Declaration type has been replaced by 3 icons: CRS701, CRS702, CRS703. Select the Declaration type you need.

CRS701: The message contains new information

CRS702: The message contains corrections / cancellations for data previously reported

CRS703: The message informs that there are no data to declare by Luxembourg Reporting Financial Institution for the fiscal year indicated.

Reporting period

In the new e-file version the drop down list for the Reporting period has been replaced by icons.

Select the icon that contains the tax year to which the message relates.

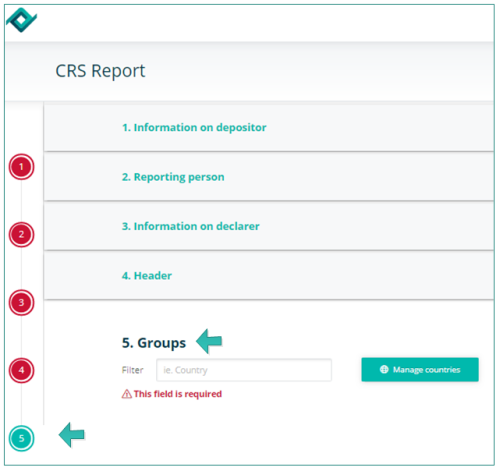

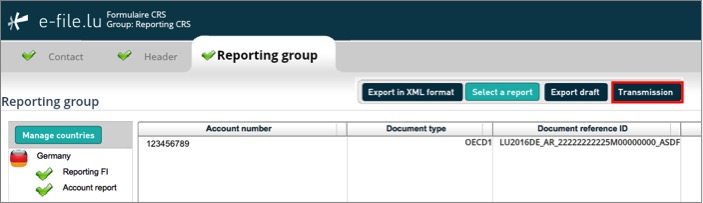

Reporting group

BEFORE

In the old e-file version all information in relation to Manage country, Reporting FI and Account report were available in the Reporting group tab.

AFTER

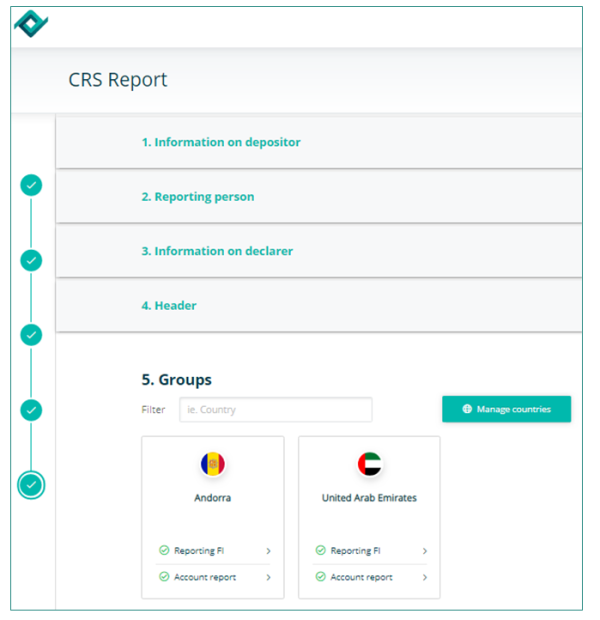

In the new e-file version all information in relation to Manage country, Reporting FI and Account report are available in section 5 Groups of the form.

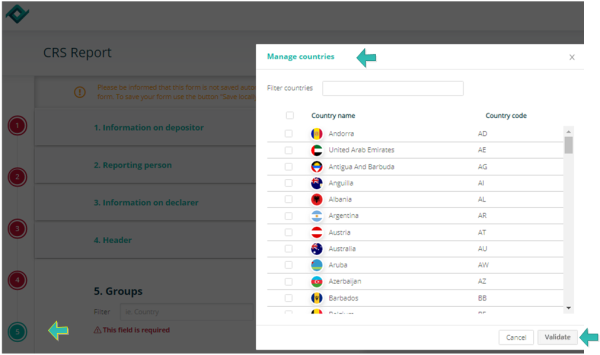

Manage countries

Click on the section 5 icon. A window Manage countries pops-up. Select the country and click the Validate button.

In our case we selected Andorra and United Arab Emirates:

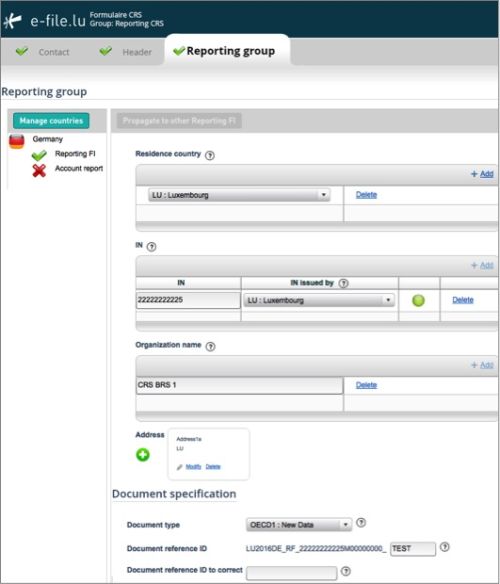

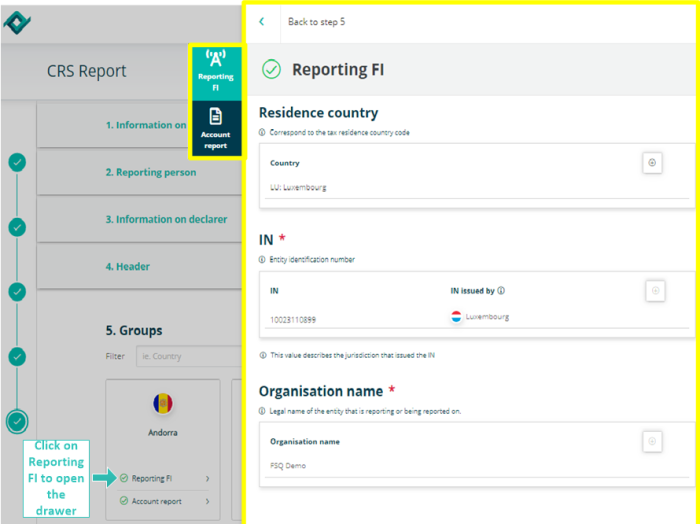

Reporting FI

Click on the Reporting FI icon ![]() as indicated above. The drawer Reporting FI, which we highlighted in yellow, opens.

as indicated above. The drawer Reporting FI, which we highlighted in yellow, opens.

Complete the fields. Mandatory fields are marked with a red asterix.

Residence country

The country or countries of tax residence of the Luxembourg RFI. The "Residence country" element corresponds to the country or countries of tax residence of the Luxembourg RFI. There must be at least one element which has the value "LU". In addition, the value of the "Residence country" element must be equal to the value of the "TransmittingCountry" element, otherwise the file is rejected with error code 60013.

Cf. ECHA - n° 4 of 6 February 2017, page 34.

IN

The tax identification number(s) of the RFI. At least the Luxembourg Personal Identification Number (Matricule) of the Luxembourg RFI must be present.

Organization name

The name of the Reporting Financial Institution (RFI). The RFI is the entity that is subject to the CRS Reporting.

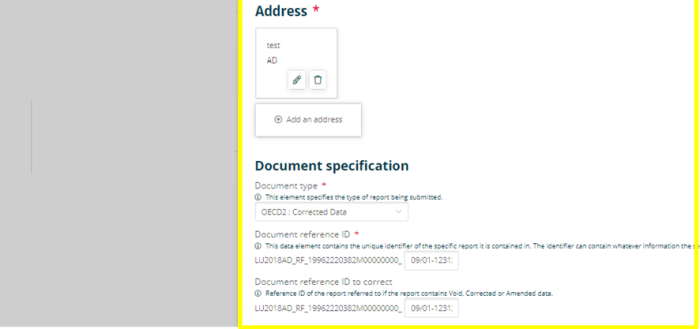

Address

The address of the RFI

Cf. ECHA - n° 4 of 6 February 2017, page 31.

Document type

This element specifies the type of data to be transmitted

OECD0: Resend data

OECD1: New data

OECD2: Corrected data

OECD3: Deletion of data

Important:The file is rejected in case of Document type = OECD3 and if all account reports related to this Reporting FI have not previously been deleted.

Cf. ECHA - n° 4 of 6 February 2017, page 32.

Document reference ID

Cf. chapter 2.4.1.1 AEOI reference

Document reference ID to correct

This element is a reference to the unique identifier of the data that is to be corrected / deleted and its value must be known by the ACD because it had been previously transmitted via a new data message.

Cf. ECHA - n° 4 of 6 February 2017, page 33.

Account Report

The Account Report can only be omitted if the Reporting FI is being corrected (OECD2) / deleted (OECD3) or, in the case of domestic reporting, if there is nil reporting (CRS703). If the Reporting FI indicates new data or resent data, then the Account Report must be provided.

Document type

OECD0: Resent data. This value is not authorized in the context of account reports

OECD1: New data

OECD2: Corrected data

OECD3: Deletion of data

Document Reference Id

Cf. chapter 2.4.1.1 AEOI reference

Cf. ECHA - n° 4 of 6 February 2017, page 39.

Document Reference ID to correct

This ID references the Document Reference ID of the element to be corrected (OECD2) or deleted (OECD3). It must always refer to the latest reference of this Account Report (Document Reference ID) that was sent.

Cf. ECHA - n° 4 of 6 February 2017, page 40.

Organisation

Account Number type

OECD601: IBAN - International Bank Account Number

OECD602: OBAN - Other Bank Account number

OECD603: ISIN - International Securities Identification Number

OECD604: OSIN _ Other Securities Identification Number

OECD605: Other

Account holder type

If the account holder is an organisation, select the account holder type:

CRS101 = Passive Non-Financial Entity with - one or more controlling person that is a Reportable Person

CRS102 = CRS Reportable Person

CRS103 = Passive Non-Financial Entiy that is a CRS Reportable Person

Type of message

New data message

A new data message is a message declaring data that is not yet known by the ACD. It is characterized by the value "CRS701" and by the value "OECD1"

Correction message

A correction message is a message that corrects or cancels data already known by the ACD. It is characterized by the value "CRS702" and the value "OECD2" or "OECD3".

Zero Reporting

A "ZeroReporting" message is a message stating that the Luxembourg Reporting Financial Institution has no data to report for the relevant tax year.

Unlike FATCA, the ACD has decided that filing a "zero reporting" is not mandatory.

Cf. ECHA - n° 4 of 6 February 2017, page 17

Step 1: Select Zero Report

Step 2: Complete the Contact tab

Cf. Chapter 2.4.1 Contact tab

Step 3: Complete the Header tab

The declaration type CRS703: The message advises thers is no data to report is selected by default.

Step 4: Complete the Reporting tab

Important:

-The RFI should not declare any Account Report in a Zero Report.

-The Zero Reporting has to be filed to the ACD. It will not be communicated to a particular JSD ("Juridiction soumise à déclaration").

-The Zero Reporting will be rejected if the Luxembourg Financial Institution has already transmitted data via a new data message but this data has not been canceled via a correction message. All declared data must be canceled before sending a Zero Reporting. Otherwise, the error "80009" is returned.

Cf. ECHA - n° 4 of 6 February 2017, page 17

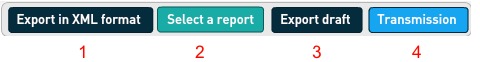

Export - import files - save work in progress

1. Click this button to export the final report in XML format. The file will be saved on your hard drive and is available for sending to the Regulator. This button will only be available if the green tick ![]() appears in every section of the completed form.

appears in every section of the completed form.

2. This button allows you to upload an existing XML report from your network or hard drive into the report generator.

3. Work in progress on a report has to be saved with this button. The exported .xml file will be called DRAFT_filename.xml and cannot be uploaded for filing. It can be imported onto the tool for later use. Only final reports will carry the correct naming convention for submission to the Regulator.

4.If green ticks ![]() appear in every section of the completed form, the Transmission button will become available.

appear in every section of the completed form, the Transmission button will become available.

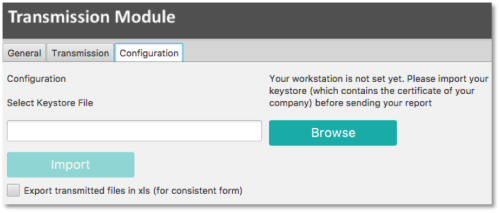

File transmission

Setup of the Transmission Module e-file v2

Step 1. Complete the form.

Result: all ticks become green

Step 2: Click thebutton.

Result: the EfileCrypto.jnlp file is generated.

IMPORTANT: this file has to be downloaded (if you use the application for the first time) locally on your computer and must be opened to launch the Transmission Module.

Note: the Transmission Module is a Java application. For security reasons, this module aims at encrypting documents before they are sent to authorithies. It is also used to decrypt documents and feedbacks.

See prerequisites for the installation of the Transmission Module e-file v2.

Step 3. Click the Open button of the EfileCrypto.jnlp file

Result: the window below opens

Step 4. Click thebutton

Result: the Transmission Module is launched

Result: the Transmission Module is launched

Important: It is possible that the pop-up blocker does not allow .jnlp files to be downloaded. Please ask your IT deparment to allow pop-ups from https://www.e-file.lu/ .

Step 5: The Transmission Module has to be configured when it is used for the first time (or after each Java update).

The path to the keystore has to be selected with the ![]() button and the key (locally or on a server) will have to be imported with the

button and the key (locally or on a server) will have to be imported with the ![]() button :

button :

Once the key has been imported, the access to the keystore is memorized by the application.

In order to be more user friendly and to speed up the sending process, the Transmission Module will then run as a back ground process on your desktop.

If you need to end the process, right click on the icon in the taskbar and select “Close Transmission Module” :

Step 6. Return to the CRS Form (Report Generator) screen - Click thebutton - Enter a "title of file sent" - Enter the keystore password

Result: as the configuration of the Transmission Module is finished, the General Tab of the Transmission Module will be displayed directly.

Note:

-the file name is automatically generated and compliant to the ACD file naming convention.

-the ![]() button is now available and the report can be sent. A pop-up window will confirm the transmission.

button is now available and the report can be sent. A pop-up window will confirm the transmission.

Transmission follow up

PLEASE CONSULT OUR WIKIPAGE TRANSMISSION FOLLOW-UP

Automatic filing through the Sending Service

The Sending Service is Fundsquare's solution for automatically sending reports and documents to the authorities.

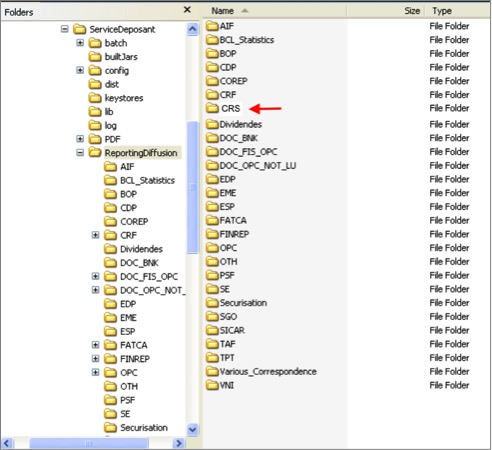

With a suitable network mapping, users can then simply copy the file to be sent in the appropriate directory.

The file is then automatically encrypted and sent.

CRS.xml files have to be dropped into the CRS subfolder:

- Should you need further information on the Sending Service, please click the links below:

Sending Service Installation Procedure

Sending Service Update Procedure

CRS file naming convention

The following naming convention has to be applied for the files:

XML file : CRS<SEP>DateHeure<SEP>MessageTypeIndic<SEP>AnnéeFiscale<SEP>Canal<SEP>MatriculeDuDéposant<SEP>MatriculeDuRFI<SEP>Environnement.xml

| Code | Definition | Structure | Values |

|---|---|---|---|

| <SEP> | Separator of the different variables of the file. The separator chosen is the underscore: _. | Char(1) | underscore: _. |

| DateHeure | Creation date and time of the XML file | Number(14) | YYYYMMDDhhmmss |

| MessageTypeIndic | CRS701: The message contains new information

CRS702: The message contains corrections for previously sent information CRS703: The message advises there is no data to report

|

Char(3)Number(3) | CRS701

CRS702 CRS703 |

| AnnéeFiscale | Fiscal year | Number(4) | YYYY |

| Canal | Communication channel | Char(1) | B = Bourse |

| MatriculeDuDéposant | Social Security Identification Number (Matricule, code CCSS) | Number(11) | 0-9 |

| MatriculeDuRFI | Concatenation of <ReportingPerson> / <IdentificationNumber> and <ReportingPerson> / <IdentificationNumberExtension> | Number(11), char(1), number(8) | 12345678901M00000000 |

| Environnement | Environment type | Char(1) | P = Production

T = Test

CRS_20170615114523_CRS701_2016_B_19751234567_01234567890M00000000_P.xml

VAL = Validated and imported by ACD ERR = File rejected |

Report transmission

File processing status generated by the Sending Service

During and at the end of the sending, the Sending Service generates various files in the subfolder that

has been used for the sending. Three type of files are generated:

- .trt file : indicates the start of the transmission

In order to be able to send the original file, the Sending Service transforms the latter into a .trt file and adds a timestamp. E.g. «OriginalName.xml» is transformed into OriginalName.xml.timestamp.trt:

.xml becomes

.trt

- .acq file : the transmission has been successfully completed

- .err file : indicates that an error has occurred during the sending

The error file contains technical messages indicating the root cause of the error, e.g. file name errors.