Difference between revisions of "FATCA Manual"

| Line 51: | Line 51: | ||

This is the Luxembourgish part of the FATCA report added by ACD. | This is the Luxembourgish part of the FATCA report added by ACD. | ||

[[File: | [[File:Contact tab.jpg]] | ||

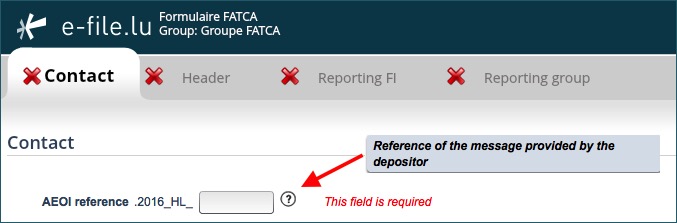

====AEOI reference==== | ====AEOI reference==== | ||

[[File:AEOI REF.jpg]] | |||

*'''AEOI reference''': free text to be provided by the Depositor. | *'''AEOI reference''': free text to be provided by the Depositor. | ||

| Line 63: | Line 65: | ||

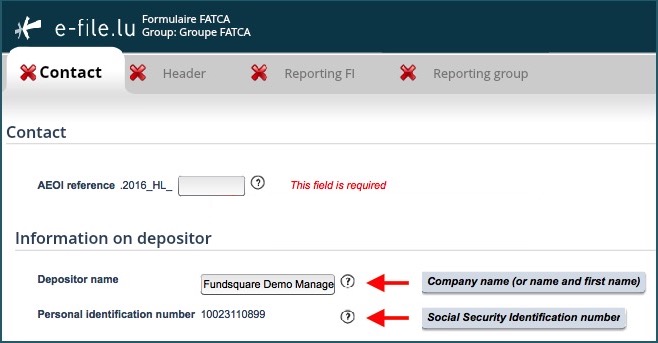

====Information on Depositor==== | ====Information on Depositor==== | ||

*The '''Depositor''' is an entity (legal or natural person) that is in charge of filing the FATCA reporting to the ACD (e.g. Service provider). | [[File:Info Dep.jpg]] | ||

*'''Depositor name''' (pre-filled): The '''Depositor''' is an entity (legal or natural person) that is in charge of filing the FATCA reporting to the ACD (e.g. Service provider). | |||

*The '''Depositor''' needs a '''Personal Identification Number''' (Luxembourgish '''Matricule''' Number also known as CCSS code) to be able to file the report. | *'''Personal Identification Number''' (pre-filled): The '''Depositor''' needs a '''Personal Identification Number''' (Luxembourgish '''Matricule''' Number also known as CCSS code) to be able to file the report. | ||

If the '''Depositor''' does not have a Luxembourgish '''Matricule''' Number, he has to contact the | If the '''Depositor''' does not have a Luxembourgish '''Matricule''' Number, he has to contact the '''Bureau de la retenue d'impôt sur les intérêts''' | ||

-by mail: aeoi@co.etat.lu | -by mail: aeoi@co.etat.lu | ||

-by phone: [http://www.impotsdirects.public.lu/fr/profil/organigramme/liste_telephone_service.html#srii Phone book_Bureau de la retenue d'impôt sur les intérêts] | -by phone: [http://www.impotsdirects.public.lu/fr/profil/organigramme/liste_telephone_service.html#srii Phone book_Bureau de la retenue d'impôt sur les intérêts] | ||

'''IMPORTANT: all pre-filled data have to be communicated to Fundsquare in order to be available in the FACTA form.''' | |||

| Line 78: | Line 85: | ||

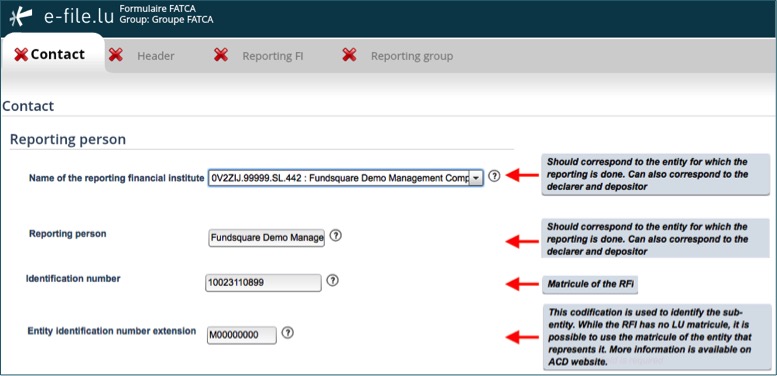

The Reporting Person is the Reporting Financial Institution (RFI). This element is used by the ACD for tracking purposes (i.e. in case of Zero Reporting). | The Reporting Person is the Reporting Financial Institution (RFI). This element is used by the ACD for tracking purposes (i.e. in case of Zero Reporting). | ||

It is the same entity as in the " | It is the same entity as in the "Reporting FI" tab. | ||

[[File: | [[File:RepPERSON.jpg]] | ||

*'''Name of the reporting financial institute''': Select the entity in the drop-down list for which the reporting is done. | *'''Name of the reporting financial institute''': Select the entity in the drop-down list for which the reporting is done. | ||

*'''Reporting person''' (pre-filled once the RFI has been selected) | *'''Reporting person''' (pre-filled once the RFI has been selected) | ||

*'''Identification number''' ( | *'''Identification number''' (pre-filled with the Luxembourgish '''Matricule''' Number once the RFI has been selected) | ||

*'''Entity Identification number extension''' (pre-filled with the value "M00000000"): "M00000000" is the default value if you have no extention code to communicate. | *'''Entity Identification number extension''' (pre-filled with the value "M00000000"): "M00000000" is the default value if you have no extention code to communicate. | ||

'''IMPORTANT''': If a sub-entity has to file a FATCA reporting and does not have a Luxembourgish '''Matricule''' Number, it must enter the parent Luxembourgish '''Matricule''' Number in the first field and an additional identifier in the second field. For example, sub-funds have to enter the Luxembourgish '''Matricule''' Number of the umbrella fund in the '''Identification Number''' field and enter the sub-fund number in the '''Entity Identification number extension''' field. | '''IMPORTANT''': If a sub-entity has to file a FATCA reporting and does not have a Luxembourgish '''Matricule''' Number, it must enter the parent Luxembourgish '''Matricule''' Number in the first field and an additional identifier in the second field. For example, sub-funds have to enter the Luxembourgish '''Matricule''' Number of the umbrella fund in the '''Identification Number''' field and enter the sub-fund number in the '''Entity Identification number extension''' field. | ||

If the RFI has no Luxembourgish '''Matricule''' Number the instructions published on the ACD website have to be followed (Cf.: [http://www.impotsdirects.public.lu/fr/profil/organigramme/direction/division_echange_renseignements_retenue_interets.html Contact_Division échange de renseignements et retenue d’impôt sur les intérêts]). | If the RFI has no Luxembourgish '''Matricule''' Number the instructions published on the ACD website have to be followed (Cf.: [http://www.impotsdirects.public.lu/fr/profil/organigramme/direction/division_echange_renseignements_retenue_interets.html Contact_Division échange de renseignements et retenue d’impôt sur les intérêts]). | ||

| Line 91: | Line 99: | ||

'''IMPORTANT: all selectable and pre-filled data have to be communicated to Fundsquare in order to be available in the FACTA form.''' | '''IMPORTANT: all selectable and pre-filled data have to be communicated to Fundsquare in order to be available in the FACTA form.''' | ||

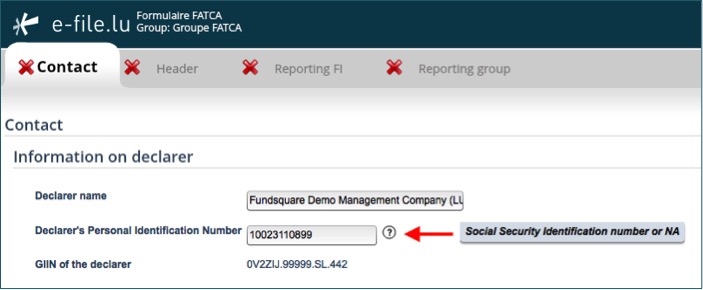

====Information on declarer==== | ====Information on declarer==== | ||

*Declarer name (pre-filled once the RFI has been selected in the '''Reporting Person''' section) | The declarer is a Financail Institution that is repsonsible for the reporting. | ||

*Declarer's Personal Identification Number (pre-filled once the RFI has been selected in the '''Reporting Person''' section) | |||

*GIIN of the declarer (pre-filled once the RFI has been selected in the '''Reporting Person''' section) | [[File:Declarer.jpg]] | ||

*Declarer name (pre-filled once the RFI has been selected in the '''Reporting Person''' section): the name and address of the related Reporting Luxembourg Financial Institution | |||

*Declarer's Personal Identification Number (pre-filled once the RFI has been selected in the '''Reporting Person''' section): Luxembourgish '''Matricule''' Number | |||

*GIIN of the declarer (pre-filled once the RFI has been selected in the '''Reporting Person''' section): GIIN | |||

*Personal information: The Declarer can be either the FI subject to the reporting obligation or an entity such as the management company or a trustee handling the reports for the FI. The Luxembourg tax authority needs the contact details of a reachable person from the Back Office who has detailed knowledge regarding the content of the report. Please note, questions regarding the format of the report should be dealt with by the Depositor. | |||

== Work in progress, export and import of reports == | |||

Work in progress on a report can be saved with the [[File:ExportDraft.png | border]] button. The exported .xml file will be called DRAFT_filename.xml and cannot be uploaded for FATCA filing. It can be imported for later use. <br/> | |||

The final reported can be saved via the [[File:ExportXMLFormat.png | border]] button. This button will only be available if the green Icon [[File:GreenIcon.png]] appears in every section and the report has been completed. The file will be saved in xml format with the required naming convention. It will be saved on your hard drive and is available for sending to the Regulator. <br/> | |||

The [[File:selectReport.png]] button allows you to upload an existing report in .xml from your network or | |||

harddrive into the report generator. <br/> | |||

== Transmission with the Report Generator == | |||

=== Setup of the e-file v2 encryption module v2 === | |||

A completed report can be sent with the [[File:Transmission.png | border]] button. Java version 1.7.55 is a prerequisite for the installation of the e-file v2 encryption module. <br/> | |||

When the [[File:Transmission.png | border]] button is used for the first time, a Java application will be downloaded (.jnlp) in order to install the encryption module locally on your computer. <br/> | |||

Please hit [[File:RunButton.png | border]] when the following window appears on your screen in order to launch the encryption module. <br/> | |||

[[File:JavaEfileWindow.png | border]] | |||

'''Warning:''' It is possible that the pop up blocker prevents that the .jnlp file is downloaded. Please check | |||

with your IT to allow pop ups from https://www.e-file.lu/ . <br/> | |||

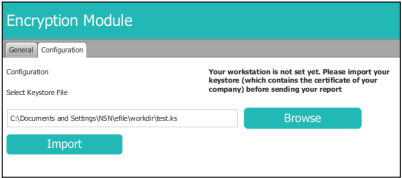

The encryption module has to be configured when it is used for the first time (or after each Java | |||

update). The path to the keystore has to be selected with the [[File:BrowseButton.png | border]] button and the key (locally or on a server) will have to be imported with the [[File:ImportButton.png |border]] button : <br/> | |||

[[File:EncryptionConfig.png |border]] | |||

After the import of the key, the access to the keystore is saved and does not have to be reconfigured | |||

in the future. You will be redirected to the sending screen and reports can now be sent with e-file v2. | |||

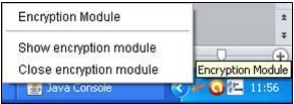

In order to be more user friendly and to speed up the sending process, the encryption module runs as | |||

a back ground process on your desktop. In order to end the process, right click on the icon in the | |||

taskbar and select “Close encryption module” : <br/> | |||

[[File:EncryptionTaskbar.png |border]] | |||

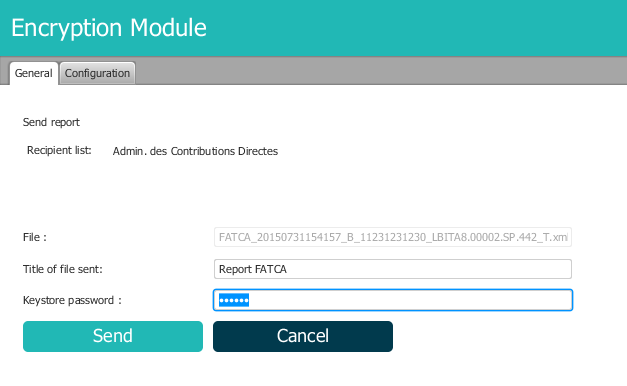

After the installation of the encryption module on your desktop, reports can be sent from the Report | |||

Generator with the [[File:Transmission.png | border]] button. In the following window, the file name is automatically | |||

generated and compliant to the ACD naming convention : <br/> | |||

[[File:EncryptionGeneral.png | border]] | |||

After entering a name for the sending (this name will also be used for search queries) and entering the | |||

keystore password, the report can be sent with the [[File:SendButton.png | border]] button. A popup window will confirm the transmission. | |||

= Naming convention = | = Naming convention = | ||

| Line 166: | Line 225: | ||

FATCA report created the 31/07/2015 via Bourse’s channel, with CCSS code 11231231230 GIIIN code LBITA8.00002.SP.442, in the test environment and has been received by ACD. <br/> | FATCA report created the 31/07/2015 via Bourse’s channel, with CCSS code 11231231230 GIIIN code LBITA8.00002.SP.442, in the test environment and has been received by ACD. <br/> | ||

= Automatic Sending with the Sending Service = | = Automatic Sending with the Sending Service = | ||

| Line 304: | Line 319: | ||

=FATCA FAQ= | =FATCA FAQ= | ||

==How to modify an existing report ?== | ==How to modify an existing report ?== | ||

Revision as of 18:51, 19 March 2017

Introduction

The Luxembourg Tax Authoritiy (Administration des contributions directes (ACD)) published on 19 January 2017 an updated version of the circular ECHA3 defining the new format that takes into account the Internal Revenue Services (IRS) FATCA XSD 2.0. Luxembourg Financial Institutions will have to use this new schema, as it will be the only one accepted as from now.

Manual filing through e-file v2

Environment

- Select your environment:

Production environment : https://www.e-file.lu/e-file/

Homologation environment (Test) : https://homologation.e-file.lu/e-file/

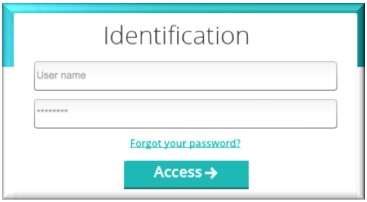

Login

- Enter your e-file login credentials (user name and password) and click the Access button.

IMPORTANT: If you do not have an e-file user account or if you do not remember your password, you might contact your e-file administrator of your company.

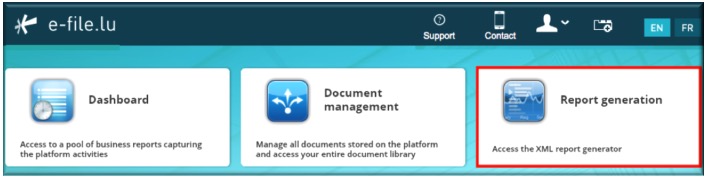

Access FATCA form

- Click on the Report Generation icon:

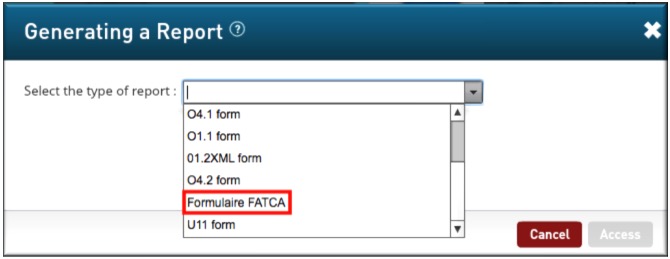

- Select Formulaire FATCA

Result: the FATCA form opens

Complete FATCA form

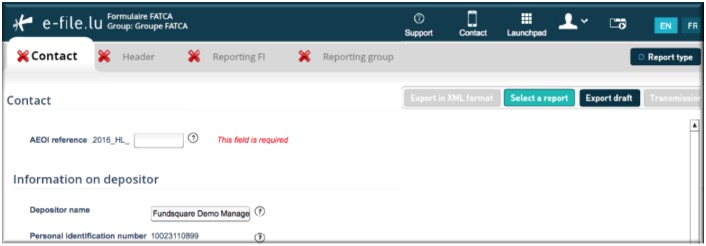

Contact tab

This is the Luxembourgish part of the FATCA report added by ACD.

AEOI reference

- AEOI reference: free text to be provided by the Depositor.

- Specifications of the free text: maximum length 100 characters, only capital characters, number 0-9, must be unique, etc.; Cf. details ECHA3, page 13.

- Our FATCA form respects all these specifications by default. Please note that the XSD of the ACD does not check these specifications on our Sending Service and your reporting might be rejected by the ACD.

Information on Depositor

- Depositor name (pre-filled): The Depositor is an entity (legal or natural person) that is in charge of filing the FATCA reporting to the ACD (e.g. Service provider).

- Personal Identification Number (pre-filled): The Depositor needs a Personal Identification Number (Luxembourgish Matricule Number also known as CCSS code) to be able to file the report.

If the Depositor does not have a Luxembourgish Matricule Number, he has to contact the Bureau de la retenue d'impôt sur les intérêts

-by mail: aeoi@co.etat.lu

-by phone: Phone book_Bureau de la retenue d'impôt sur les intérêts

IMPORTANT: all pre-filled data have to be communicated to Fundsquare in order to be available in the FACTA form.

Reporting person

The Reporting Person is the Reporting Financial Institution (RFI). This element is used by the ACD for tracking purposes (i.e. in case of Zero Reporting).

It is the same entity as in the "Reporting FI" tab.

- Name of the reporting financial institute: Select the entity in the drop-down list for which the reporting is done.

- Reporting person (pre-filled once the RFI has been selected)

- Identification number (pre-filled with the Luxembourgish Matricule Number once the RFI has been selected)

- Entity Identification number extension (pre-filled with the value "M00000000"): "M00000000" is the default value if you have no extention code to communicate.

IMPORTANT: If a sub-entity has to file a FATCA reporting and does not have a Luxembourgish Matricule Number, it must enter the parent Luxembourgish Matricule Number in the first field and an additional identifier in the second field. For example, sub-funds have to enter the Luxembourgish Matricule Number of the umbrella fund in the Identification Number field and enter the sub-fund number in the Entity Identification number extension field. If the RFI has no Luxembourgish Matricule Number the instructions published on the ACD website have to be followed (Cf.: Contact_Division échange de renseignements et retenue d’impôt sur les intérêts).

IMPORTANT: all selectable and pre-filled data have to be communicated to Fundsquare in order to be available in the FACTA form.

Information on declarer

The declarer is a Financail Institution that is repsonsible for the reporting.

- Declarer name (pre-filled once the RFI has been selected in the Reporting Person section): the name and address of the related Reporting Luxembourg Financial Institution

- Declarer's Personal Identification Number (pre-filled once the RFI has been selected in the Reporting Person section): Luxembourgish Matricule Number

- GIIN of the declarer (pre-filled once the RFI has been selected in the Reporting Person section): GIIN

- Personal information: The Declarer can be either the FI subject to the reporting obligation or an entity such as the management company or a trustee handling the reports for the FI. The Luxembourg tax authority needs the contact details of a reachable person from the Back Office who has detailed knowledge regarding the content of the report. Please note, questions regarding the format of the report should be dealt with by the Depositor.

Work in progress, export and import of reports

Work in progress on a report can be saved with the ![]() button. The exported .xml file will be called DRAFT_filename.xml and cannot be uploaded for FATCA filing. It can be imported for later use.

button. The exported .xml file will be called DRAFT_filename.xml and cannot be uploaded for FATCA filing. It can be imported for later use.

The final reported can be saved via the ![]() button. This button will only be available if the green Icon

button. This button will only be available if the green Icon ![]() appears in every section and the report has been completed. The file will be saved in xml format with the required naming convention. It will be saved on your hard drive and is available for sending to the Regulator.

appears in every section and the report has been completed. The file will be saved in xml format with the required naming convention. It will be saved on your hard drive and is available for sending to the Regulator.

The ![]() button allows you to upload an existing report in .xml from your network or

harddrive into the report generator.

button allows you to upload an existing report in .xml from your network or

harddrive into the report generator.

Transmission with the Report Generator

Setup of the e-file v2 encryption module v2

A completed report can be sent with the ![]() button. Java version 1.7.55 is a prerequisite for the installation of the e-file v2 encryption module.

button. Java version 1.7.55 is a prerequisite for the installation of the e-file v2 encryption module.

When the ![]() button is used for the first time, a Java application will be downloaded (.jnlp) in order to install the encryption module locally on your computer.

button is used for the first time, a Java application will be downloaded (.jnlp) in order to install the encryption module locally on your computer.

Please hit ![]() when the following window appears on your screen in order to launch the encryption module.

when the following window appears on your screen in order to launch the encryption module.

Warning: It is possible that the pop up blocker prevents that the .jnlp file is downloaded. Please check

with your IT to allow pop ups from https://www.e-file.lu/ .

The encryption module has to be configured when it is used for the first time (or after each Java

update). The path to the keystore has to be selected with the ![]() button and the key (locally or on a server) will have to be imported with the

button and the key (locally or on a server) will have to be imported with the ![]() button :

button :

After the import of the key, the access to the keystore is saved and does not have to be reconfigured

in the future. You will be redirected to the sending screen and reports can now be sent with e-file v2.

In order to be more user friendly and to speed up the sending process, the encryption module runs as

a back ground process on your desktop. In order to end the process, right click on the icon in the

taskbar and select “Close encryption module” :

After the installation of the encryption module on your desktop, reports can be sent from the Report

Generator with the ![]() button. In the following window, the file name is automatically

generated and compliant to the ACD naming convention :

button. In the following window, the file name is automatically

generated and compliant to the ACD naming convention :

After entering a name for the sending (this name will also be used for search queries) and entering the

keystore password, the report can be sent with the ![]() button. A popup window will confirm the transmission.

button. A popup window will confirm the transmission.

Naming convention

Report :

FATCA_DateTime_Channel_MatriculeReporter_GIIN_ProdTest.xml

Feedback from ACD :

FATCA_ DateTime_Channel_MatriculeReporter_GIIN_ProdTest_Status.xml

| Code | Definition | Structure | Values |

|---|---|---|---|

| DateTime | Creation date and time | Number(14) | AAAAMMJJhhmmss |

| Channel | Communication channel | Char(1) | B (Bourse) |

| MatriculeReporter | Social Security Identification Number | Number(11) - Number(13) | Code CCSS |

| GIIN | GIIN (Global Intermediary Identification Number ) of the declarer | Char(6).Char(5).Char(2).Number(3) | Code GIIN XXXXXX.XXXXX.XX.XXX |

| ProdTest | Environment type | Char(1) | P = Production

T = Test |

| Status | Response status | Char(3) | Technical Feedback

ACK = File technically received by ACD |

Examples

Report :

FATCA_20150731115912_B_11231231230_LBITA8.00002.SP.442_T.xml

FATCA report created the 31/07/2015 via Bourse’s channel, with CCSS code 11231231230 GIIIN code LBITA8.00002.SP.442, in the test environment.

Feedback from ACD :

FATCA_20150731115912_B_11231231230_LBITA8.00002.SP.442_T_ack.xml

FATCA report created the 31/07/2015 via Bourse’s channel, with CCSS code 11231231230 GIIIN code LBITA8.00002.SP.442, in the test environment and has been received by ACD.

Automatic Sending with the Sending Service

In order to send reports with the Sending Service, the following components have to be installed on your desktop:

- Java version 1.6.0.14 or higher

- Sending service version 3.3.6 or higher

Access to the Sending Service

The Sending Service is accessible with the file explorer and visible as a folder including subfolders :

The standard file structure includes a «FATCA» subfolder (by default, a subfolder for each type of reporting is included).

Sending frequency

During the setup of the sending service, the sending frequency can be individually set for each subfolder by your e-file administrator within the setup file. The default sending frequency is every 30 minutes but it can be tailored according to your needs.

Report transmission

In order to send a report with the Sending Service, the exported .xml report has to be copied into the …/ServiceDeposant/ReportingDiffusion/FATCA subfolder.

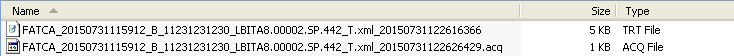

Files created by the Sending Service

During and at the end of the sending, the Sending Service generates various files in the subfolder that

has been used for the sending. Three type of files are generated:

- .trt file : indicates the start of the transmission

In order to be able to send the original file, the Sending Service transforms the latter into a .trt file and

adds a timestamp. Eg «OriginalName.xml» is transformed into OriginalName.xml.timestamp.trt:

FATCA_20150731115912_B_11231231230_LBITA8.00002.SP.442_T.xml becomes

FATCA_20150731115912_B_11231231230_LBITA8.00002.SP.442_T.xml_20150731122616366.trt

- .acq file : the transmission has been successfully completed

Example of a successful transmission :

Before the transmission :

- .err file : indicates that an error has occurred during the sending

The error file contains technical messages designed to help find the root cause of the error, eg naming errors.

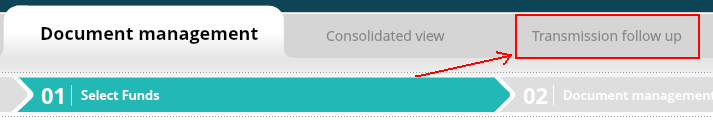

Transmission follow up

Get the feedbacks

Manual access

First connect on https://www.e-file.lu/e-file with your credentials.

Select the "Document management" module as follow :

Select "Transmission follow up" tab :

The search can be defined between 2 dates and will display all the reports sent during that period.

Each report has a status to have a quick overview of your sendings.

- "Transmitted" means that the report is currently dispatched to the ACD.

- "Feedback Received" means that at least one feedback has been received. It also means that the ACD was able to read your report.

- "To validate" means that the report needs to be validated by the declarant on E-file V2. This is a really specific case.

To see the reports and its feedback, click on the blue icon on the right.

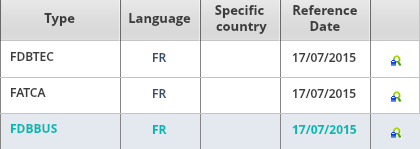

The files are displayed with a type:

- FATCA = Original report

- FDBTEC = Technical feedback

- FDBBUS = Business feedback

To read one of these files, click on the green icon on the right.

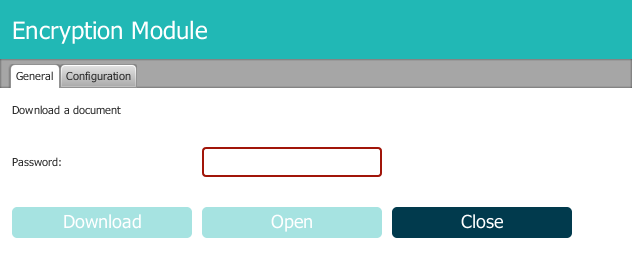

As the document is encrypted it will launch our encryption module V2.

Finally the keystore password is requested to either save the file or directly open it.

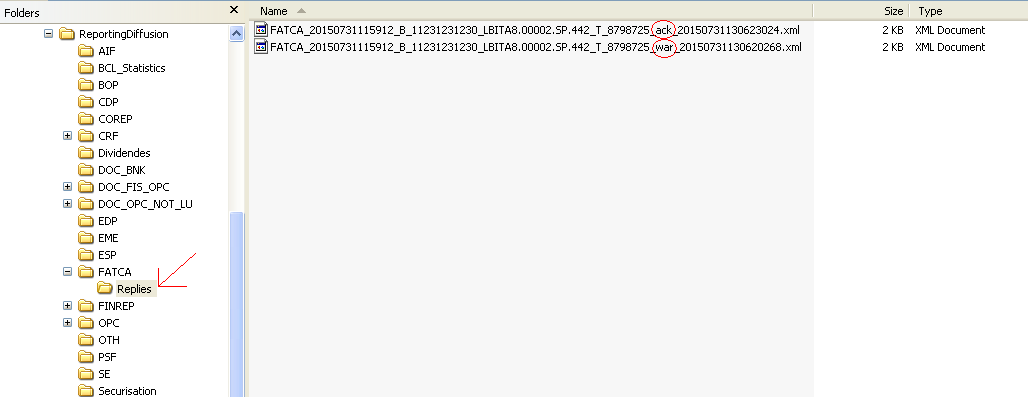

Access from Sending Service

ACD's feedbacks can be found in the sub-folder "Replies" from the following path .../ServiceDeposant/ReportindDiffusion/FATCA/Replies/.

Each feedback has a specifical status (see #Naming_convention : Status) which can be seen in the file name (ex : ack).

The "Replies" folder is created upon feedback receipt. Please check the Sending Service's configuration whether it cannot be found. In the configuration file, the variable corresponding to "Configuration of connection for feedback" and the the one corresponding to "Configuration of connection for authority acknowledgement" should be set to "up".

FATCA FAQ

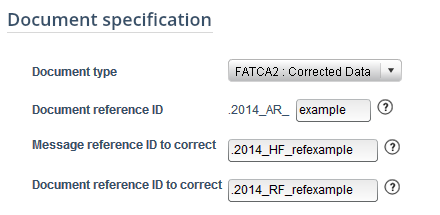

How to modify an existing report ?

In order to modify an existing report the Report Generator's form has to be completed with the new information. The type of modification to apply is set up in the "Reporting FI" section in "Document Specification" and in "Reporting Group" section in "Account Report" when clicking ![]() .

.

The different types are the following :

- FATCA1 : Initial sending. The file contains only new information

- FATCA2 : Asked modifications. The file contains only corrections asked by american's authorities (IRS)

- FATCA3 : Cancellations. The file contains only cancellations concerning previously changed information

- FATCA4 : Modifications. The file contains only corrections concerning the previously changed information on declarer's initiative

To chose the report to modify, its reference has to be entered in the document reference ID to correct and message reference ID to correct.

Why the GIINs do not appear on the form ?

To register your GIINs the contact form of our Client Service has to be fill up.

After the registration of your GIINs you will receive a confirmation mail within few days, if you haven't received the email yet please contact fatca_onboarding@fundsquare.net.

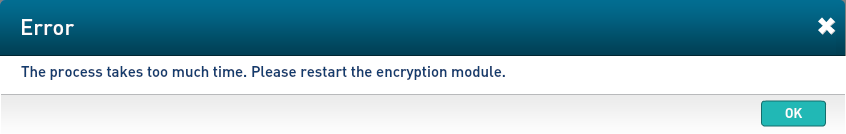

Error message : The process takes too much time. Please restart the encryption module.

The error message occurs when the encryption module is not started in time.

Please check that the pop up are enable for the site https://www.e-file.lu.

When clicking the "Transmission" button the file EfileCrypto.jnlp should be downloaded in order to launch the encryption module. You have to open this file with Java Web Start Launcher to run the module.

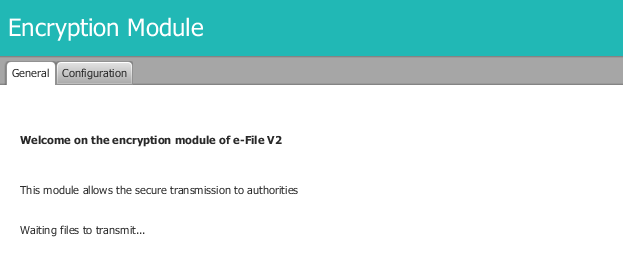

Message : Waiting files to transmit...

This error might occur when there is a connection problem between your proxy and the encryption module V2.

Close the encryption module :

Open the Java console (See http://www.e-file.lu/wiki/index.php/Encryption_Module#Show_the_console_in_case_of_other_Java_issue) and check the logs.

If an error 407 appears, it means that the encryption module is not able to authenticate on your proxy.

As a consequence all communications with E-file are blocked.

In that case the solutions to resolve this problem are the following :

- Add the group "NoAuthenticated exception group" to your proxy for www.e-file.lu

- By-pass the proxy for the communication with www.e-file.lu

For more information please call the Helpdesk.